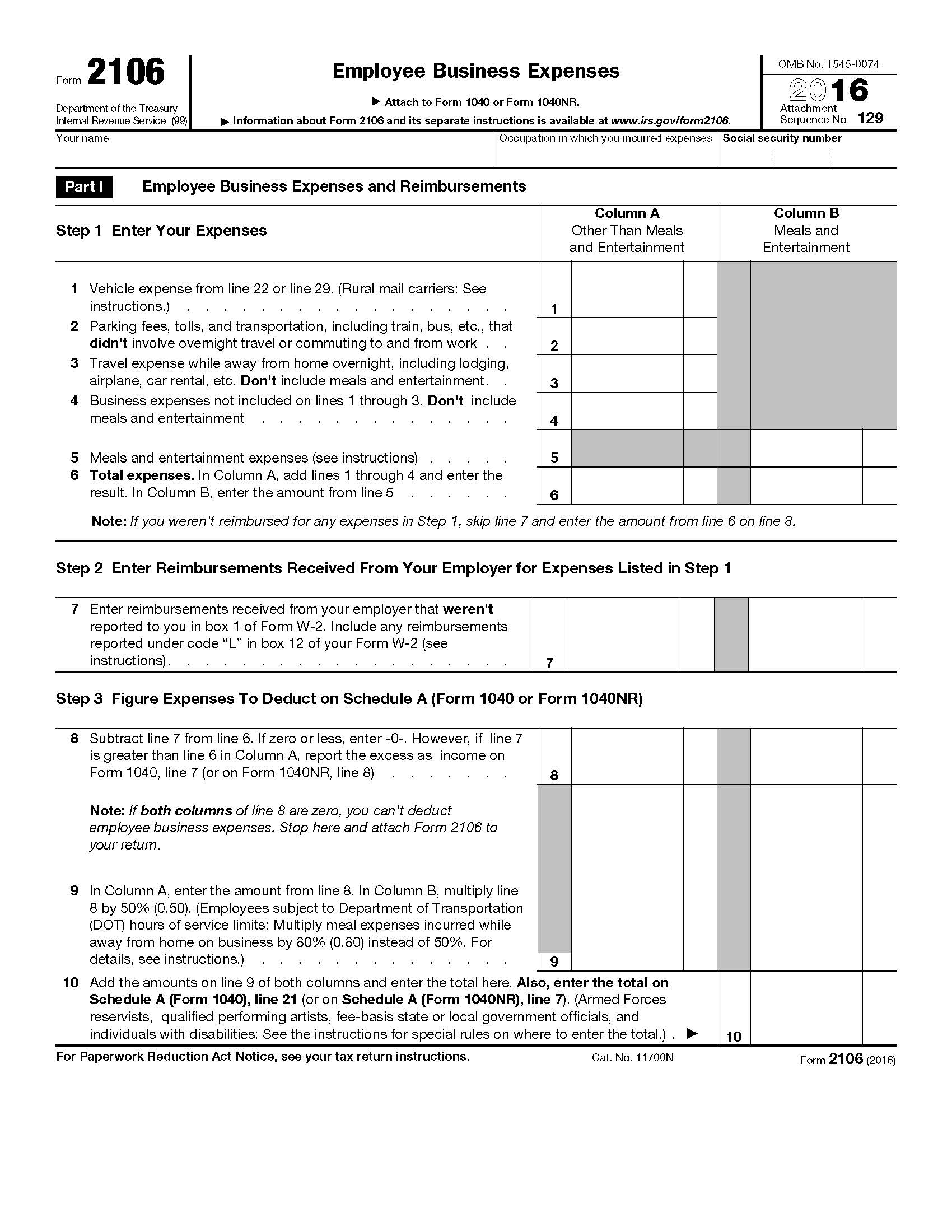

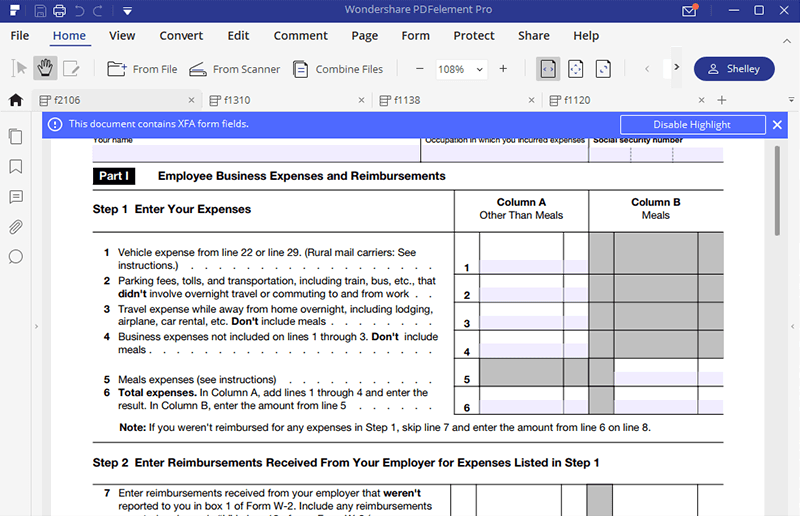

Form 2106 Instructions 2016

Instructions for form 2106 employee business expenses 2015 form 2106.

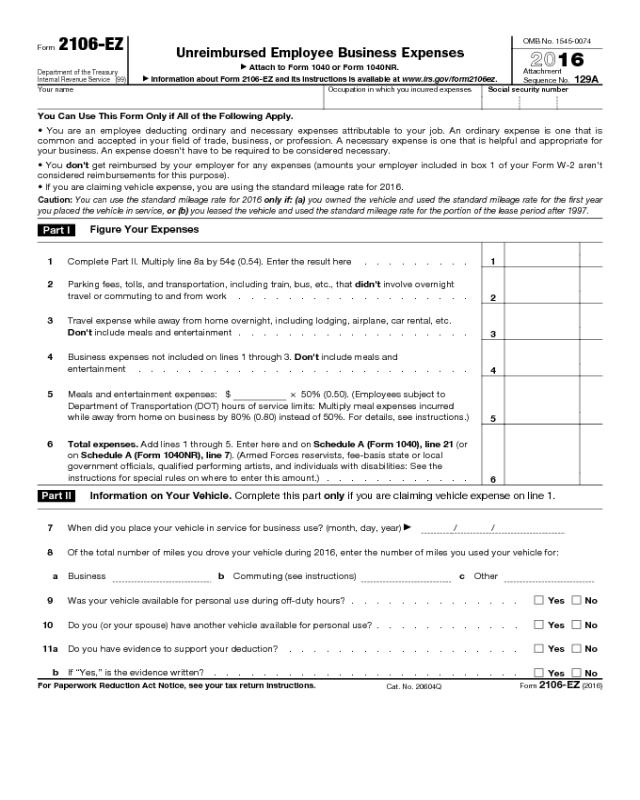

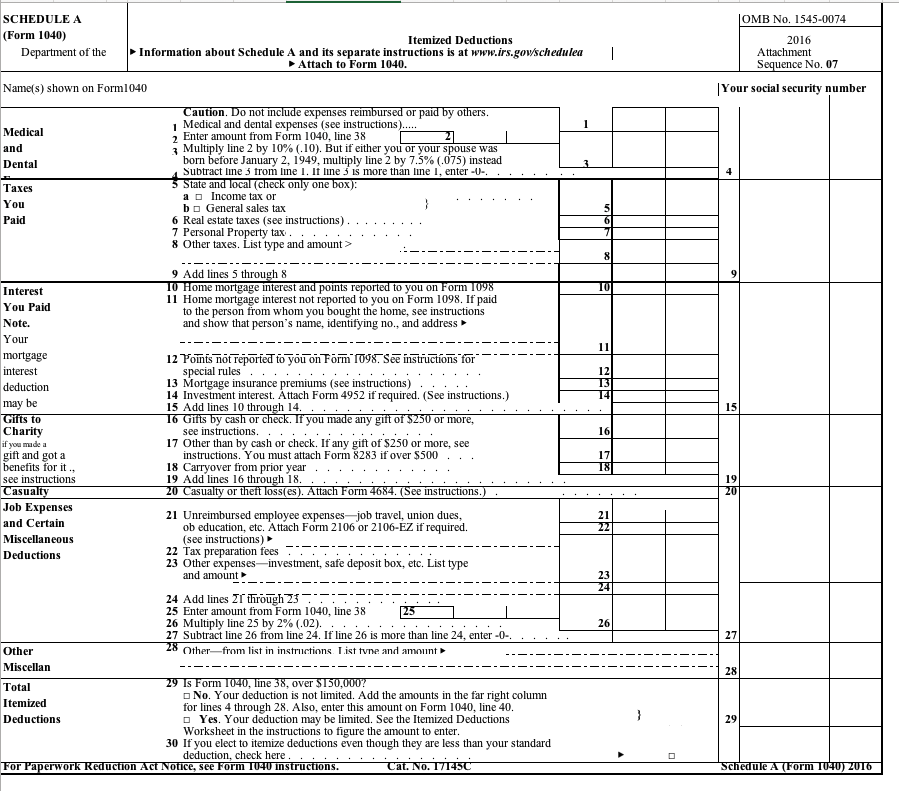

Form 2106 instructions 2016. Virgin islands form 941 x adjusted employer s quarterly federal tax return or claim for refund. Enter the smaller of line 4 or line 6. Unreimbursed employee business expenses was a tax form distributed by the internal revenue service irs and used by employees to deduct ordinary and necessary expenses related to. Instructions for form 2106 employee business expenses 2016 form 2106.

26 form 2106 templates are collected for any of your needs. 2016 instructions for form 941 ss employer s quarterly federal tax return american samoa guam the commonwealth of the northern mariana islands and the u s. Subtract line 3 from line 5 7. Add the result to any section 179 deduction line 3 above and enter the total on form 2106 line 31.

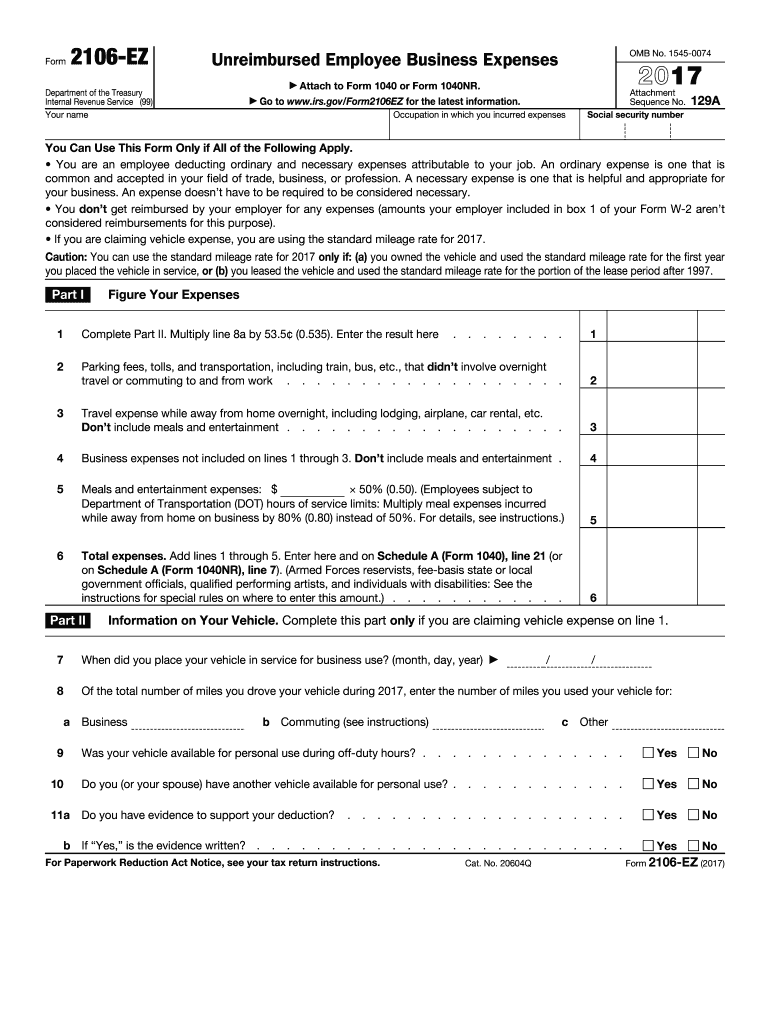

Employee business expenses 2014 inst 2106. Form 2106 ez department of the treasury internal revenue service 99 unreimbursed employee business expenses attach to form 1040 or form 1040nr. Employee business expenses 2015 inst 2106. Multiply the applicable limit explained in the line 36 instructions by the percentage on form 2106 line 14 and enter the result 6.

2016 instructions for form 2106 employee business expenses department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Instructions for form 2106 employee business expenses 2019 01 14 2020 previous 1 next get adobe reader. Access our website at www tax ny gov 2016 201 i general information it 3 general changes for 2016 revised form poa 1 form poa 1 power of attorney is being simplified for more information about the changes made to the form including instructions see our website.

/pencil-with-tax-form-on-us-dollarbills-background-507839992-5af020ea1d640400369a00ee.jpg)