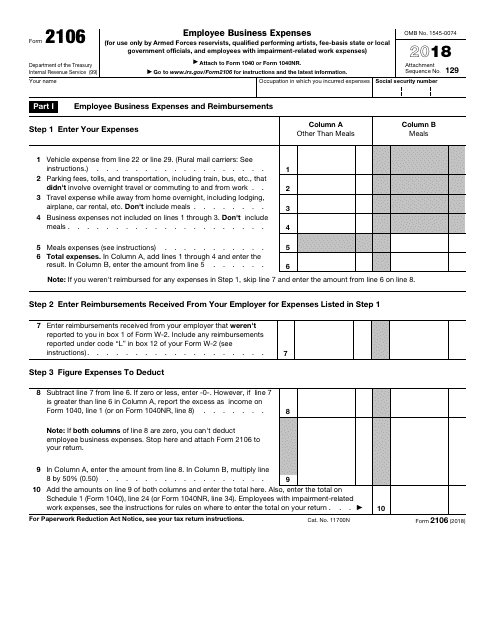

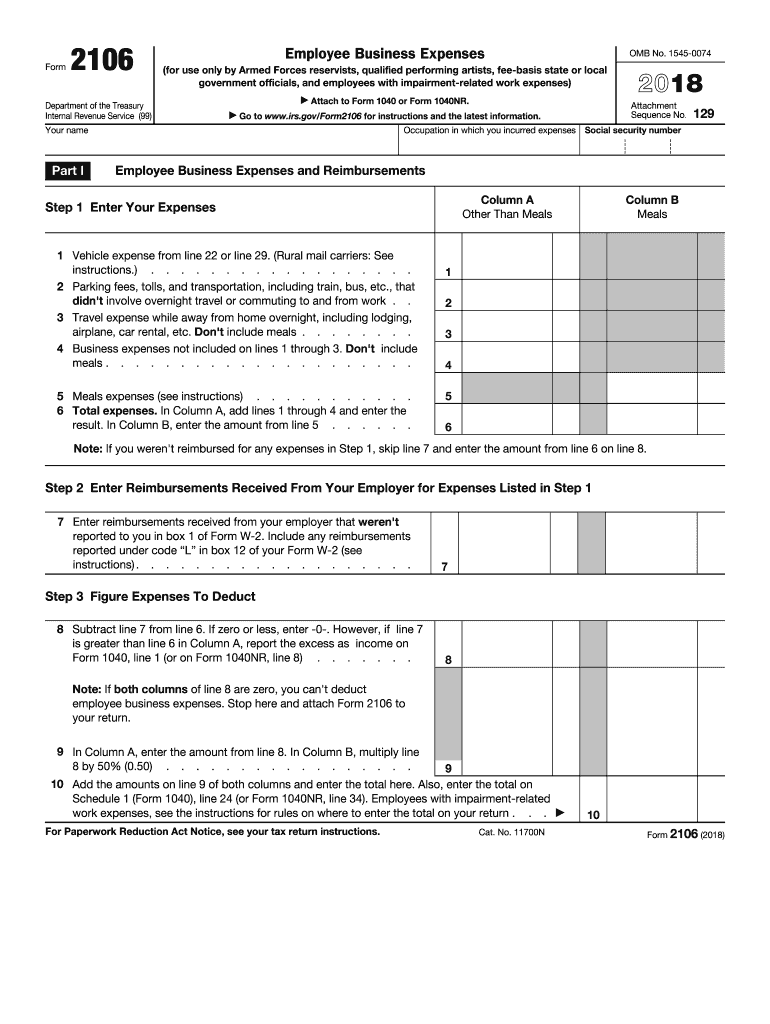

Form 2106 Instructions 2018

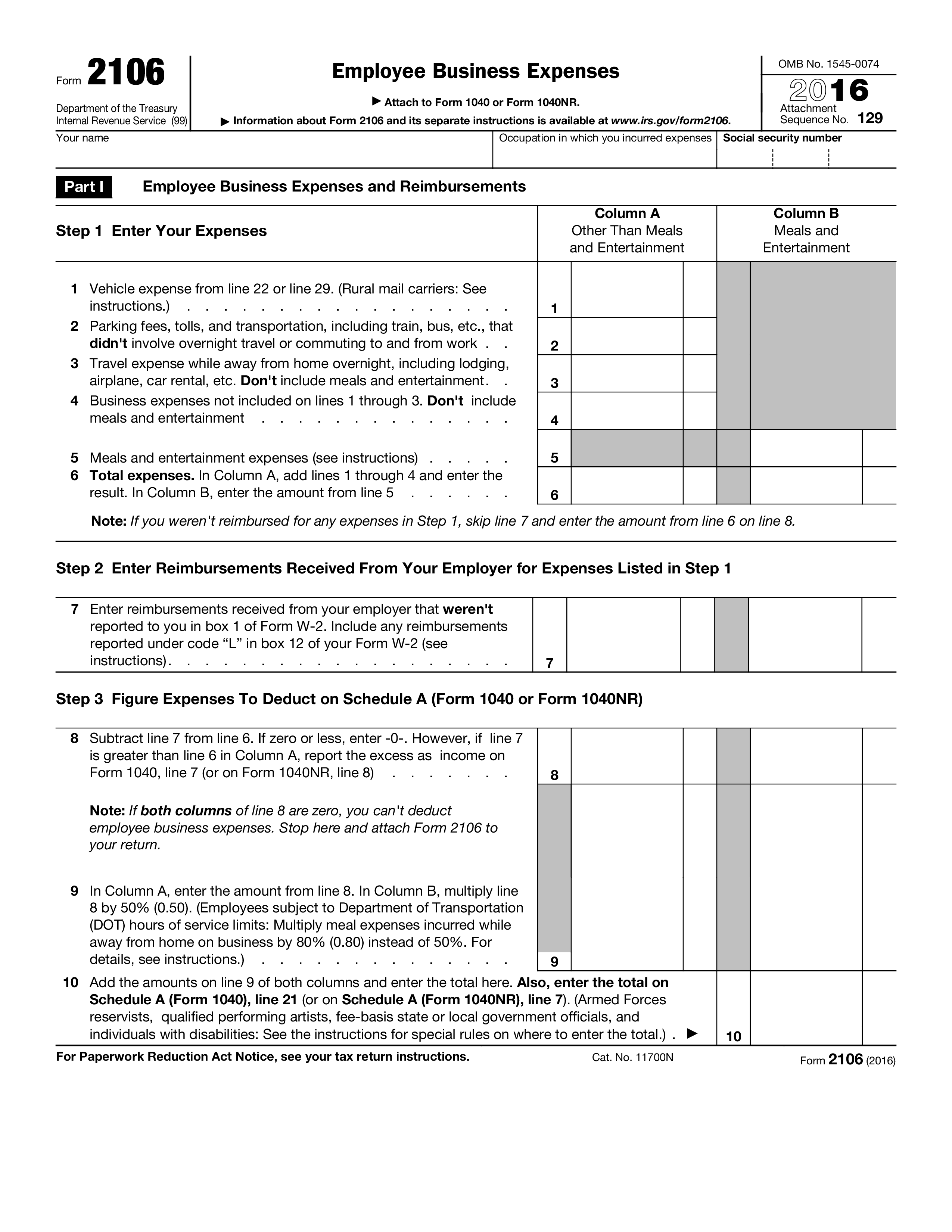

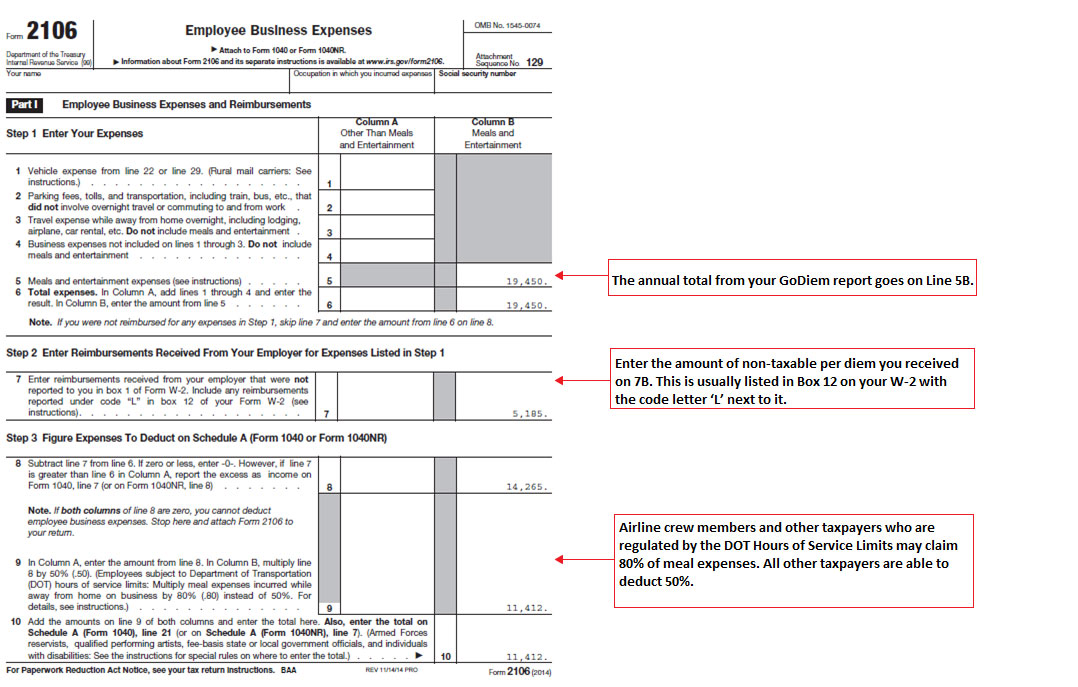

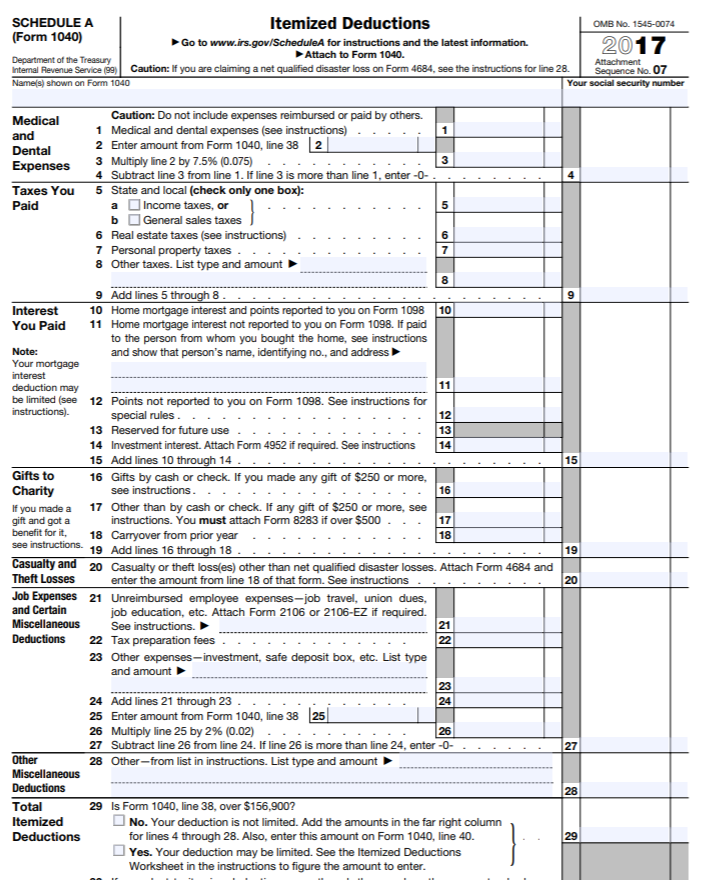

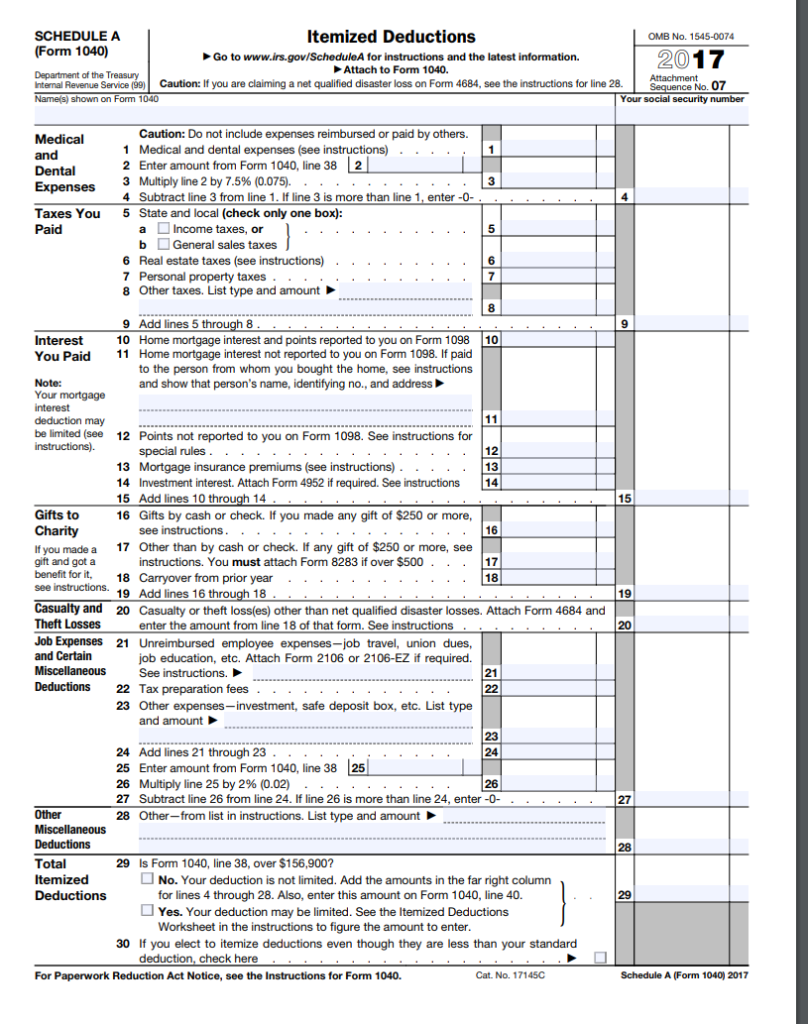

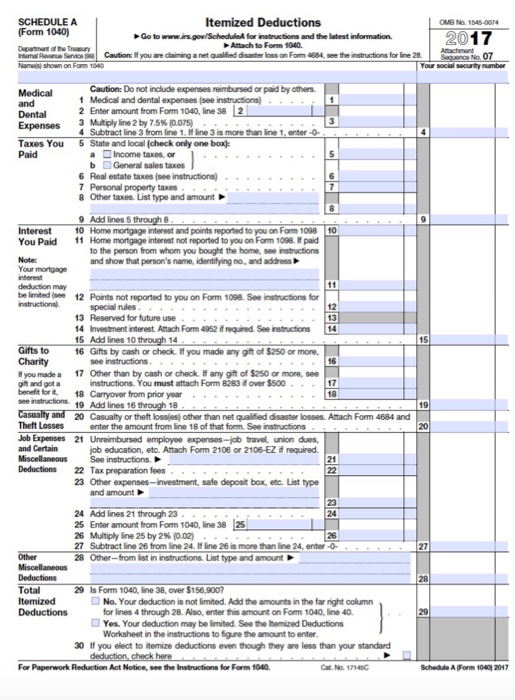

For tax years through 2017 if you itemize deductions and they include some work related expenses for travel meals entertainment or transportation including use of your own car and you don t receive reimbursement then you may need to submit irs form 2106 with your tax return.

Form 2106 instructions 2018. Add the result to any section 179 deduction line 3 above and enter the total on form 2106 line 31. Employee business expenses 2017 inst 2106. Convert them into templates for multiple use incorporate fillable fields to collect recipients. Form 2106 and its instructions such as legislation enacted after they were published go to irs gov form2106.

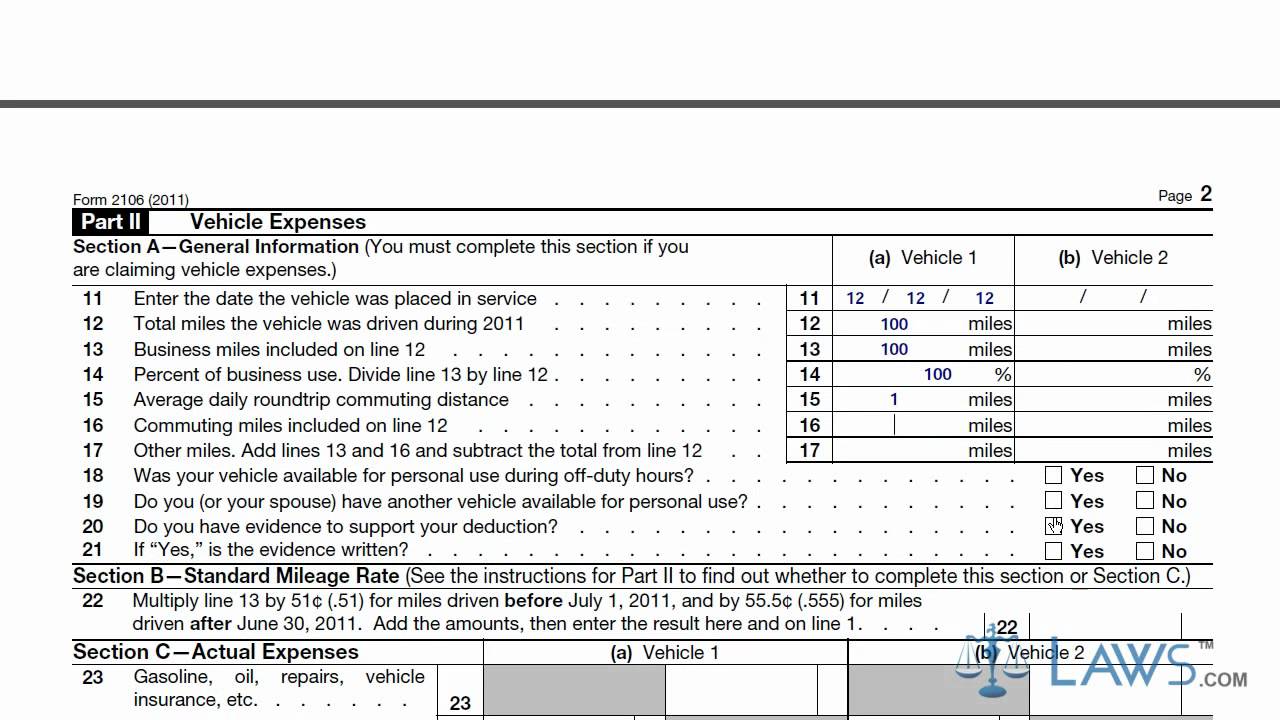

Multiply the applicable limit explained in the line 36 instructions by the percentage on form 2106 line 14 and enter the result 6. Form 2106 and instructions. Subtract line 3 from line 5 7. Form 2106 employee business expenses for use only by armed forces reservists qualified performing artists fee basis state or local government officials and employees with impairment related work expenses department of the treasury internal revenue service 99 2019 attach to form 1040 1040 sr or 1040 nr.

Irs form 2106 instructions 2019 2020. Schedule 1 form 1040 line 24 or form 1040nr line 34. Take full advantage of a digital solution to generate edit and sign documents in pdf or word format online. What s new standard mileage rate.

For tax years after 2017 unreimbursed employee expenses are no longer deductible. Data put and request legally binding digital signatures. For tax years prior to 2018 use the irs forms 2106 and 2106 ez for claiming non reimbursed expenses you incur during your normal course of work. For 2019 the first year limit on.

The 2019 rate for business use of your vehicle is 58 cents 0 58 a mile. Enter the smaller of line 4 or line 6. Instructions for form. Employees with impairment related work expenses see the instructions for rules on where to enter the total on your return.

For 2018 this form can be used only by armed forces reservists qualified performing artists fee basis state or local government officials and employees with disabilities who have impairment related work expenses. Employee business expenses 2008 inst 2106. Instructions for form 2106 employee business expenses 2018 form 2106. Instructions for form 2106 employee business expenses 2019 01 14 2020 previous 1 next get adobe reader.

Instructions for form 2106 employee business expenses 2009 form 2106.