Form 2106 Turbotax Error

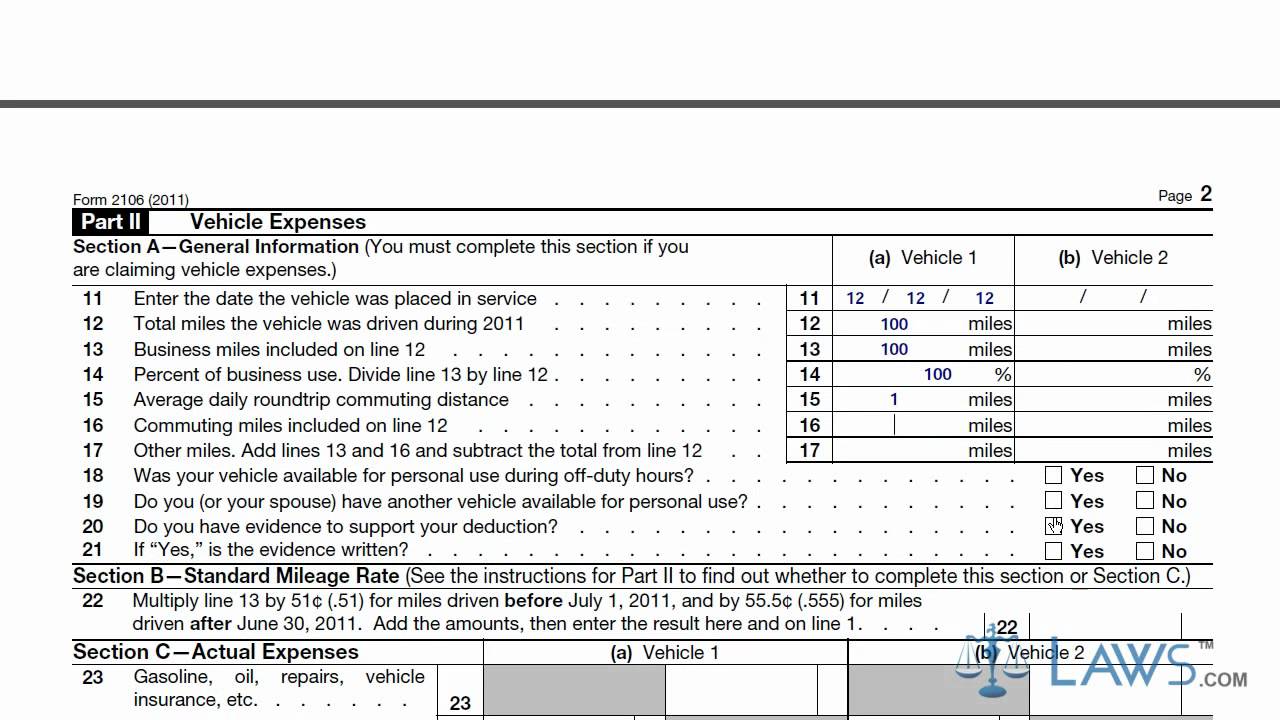

Section 179 elected in current year non vehicles only 1800 00 c.

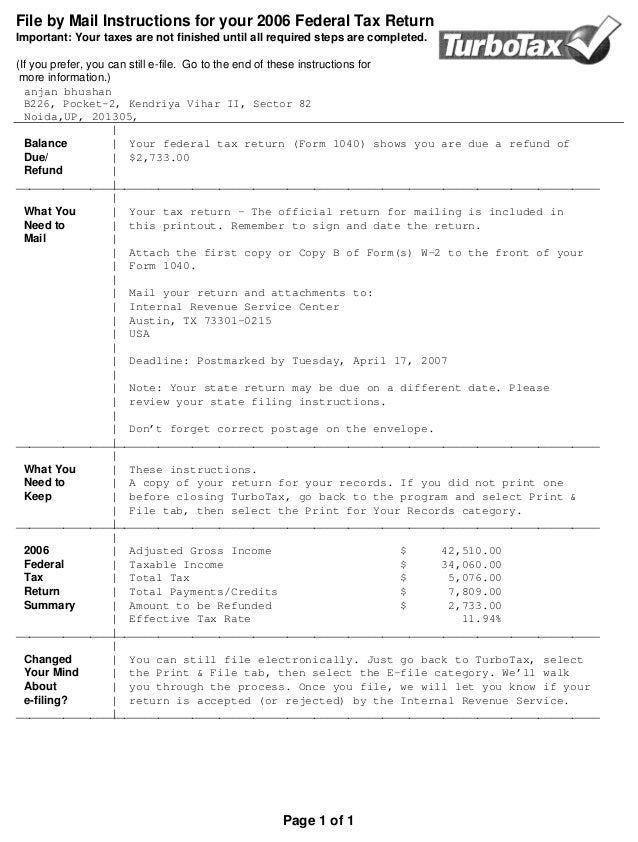

Form 2106 turbotax error. An occupation to re do your 2106 or done to exit the screen. Form 2106 line 6 line 6 is the total employee expenses that you are claiming the sum of all the expenses you entered and is done automatically. About publication 517 social security and other information for members of the clergy and religious workers. I am using turbotax online form 2106 adjustments worksheetdepreciation information smart worksheet a.

If you qualify complete form 2106 and include the part of the line 10 amount attributable to the expenses for travel more than 100 miles away from home in connection with your performance of services as a member of the reserves on schedule 1 form 1040 or 1040 sr line 11 and attach form 2106 to your return. Enter 179 carryover from prior year 3329 00 b. There are a few factors you ll want to consider when deciding which form to use. Go to search topics at the top center of the screen.

Select edit on your job related expenses summary screen to edit your employee related expenses. Employee business expenses was a tax form distributed by the internal revenue service irs used by employees to deduct ordinary and necessary expenses related to their jobs. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. Select jump to 2106 5.

To edit form 2106 in desktop before filing. All form 2106 revisions. If you are entering expenses make sure you have an amount for each item you said you would be claiming. About publication 587 business use of your home including use by daycare providers.

For tax years prior to 2018 use the irs forms 2106 and 2106 ez for claiming non reimbursed expenses you incur during your normal course of work. About publication 946 how to depreciate property. Total carryover and non vehicle section 179. Quickbooks bonus offer with turbotax self employed.

For tax years after 2017 unreimbursed employee expenses are no longer deductible. Stick to the topic we ll first search for similar questions. For tax years through 2017 use irs form 2106 if you itemize deductions for non reimbursed work related expenses such as travel meals entertainment or transportation. If you pay an irs or state penalty or interest because of a turbotax calculation error we ll pay you the penalty and interest.

File your 2016 federal return with turbotax self employed by. About publication 529 miscellaneous deductions.