Form 2441 Example

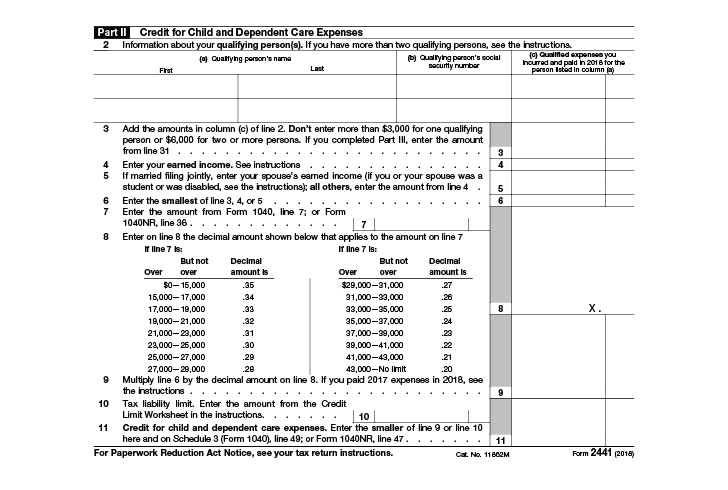

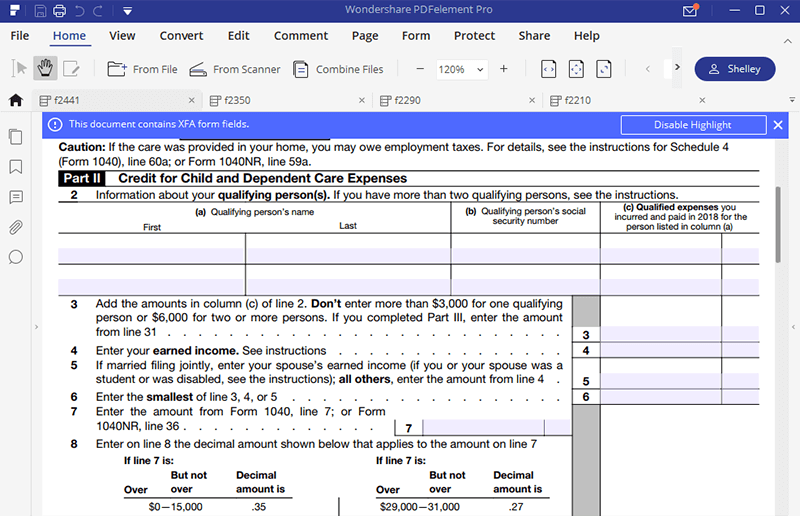

The rest of form 2441 pertains to special circumstances and credits for previous years with the exception of line 10.

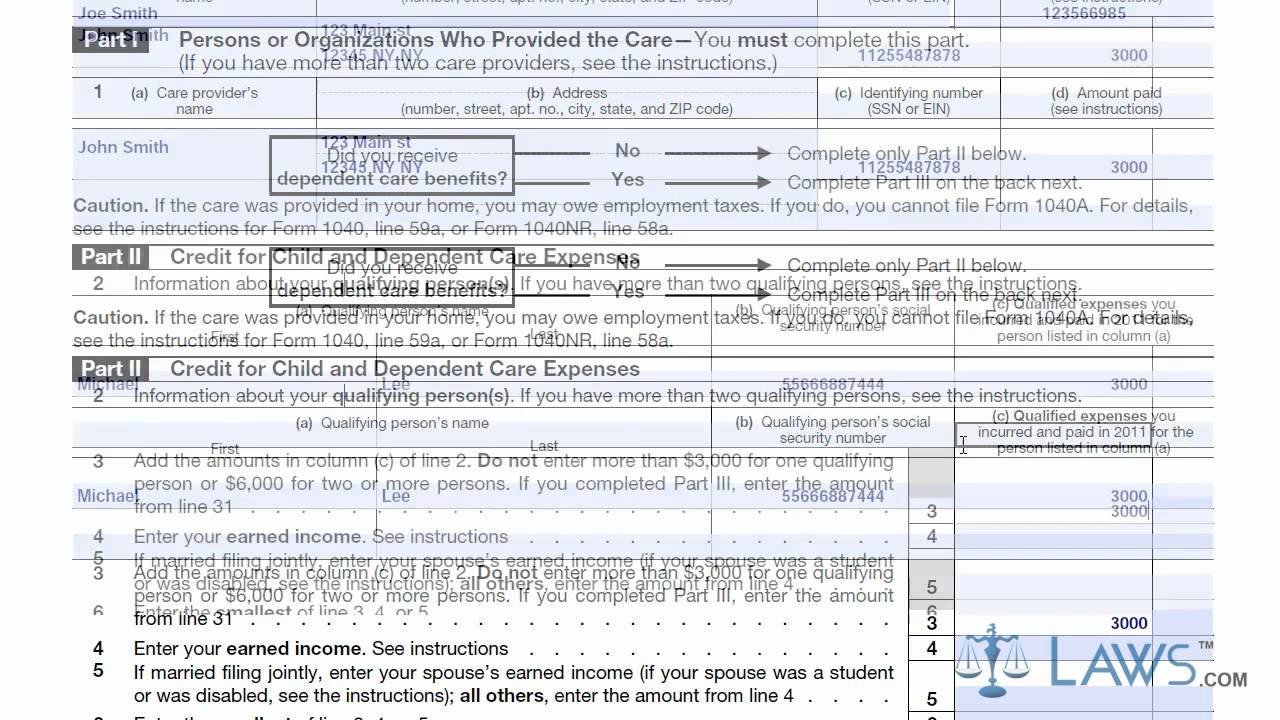

Form 2441 example. Child and dependent care expenses. The irs also requires their addresses social security or employer identification numbers and all payments they receive from you. Form 2441 care providers. This form is used to calculate whether an individual or family can take credit for child and dependent care expenses.

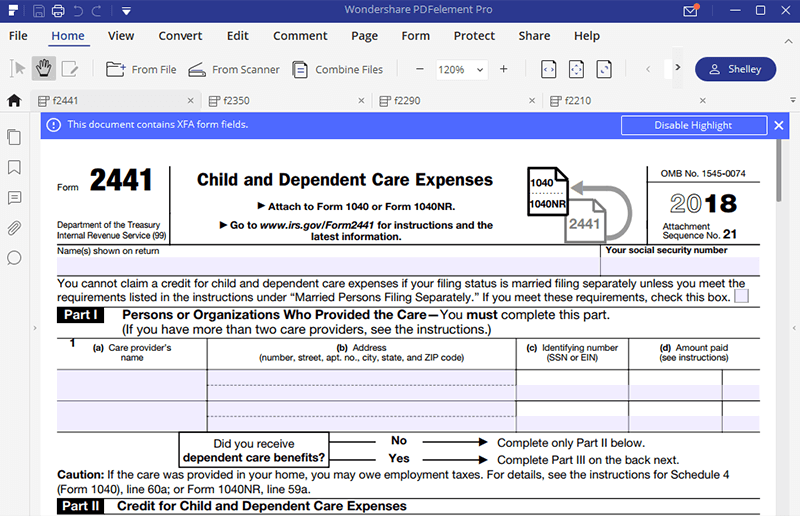

Viewer must follow form 2441 instructions to determine if this credit. Form 2441 department of the treasury internal revenue service 99 child and dependent care expenses attach to form 1040 1040 sr or 1040 nr. Example of form 2441 moreover s i ytimg vi wt5ybklx4zk maxresdefault furthermores 1 bp blogspot ky jezfbwrm vr9iykfqwbi aaaaaaaah0g 8x0jy1c4vm0 s280 imgp2441 in additions image slidesharecdn wingate university department of physician assistant studies2441 95 wingate university department of physician assistant studies 6 728 cb 1281703829 in additions static wixstatic media 904484. Complete documents electronically utilizing pdf or word format.

Boost your efficiency with powerful solution. Form 2441 is used to by persons electing to take the child and dependent care expenses to determine the amount of the credit. Information about form 2441 child and dependent care expenses including recent updates related forms and instructions on how to file. Approve forms by using a lawful electronic signature and share them via email fax or print them out.

Irs form 2441 child and dependent care expenses is a two page tax form that will take some time and concentration to fill out correctly the resulting credit likely won t pay you back for all your care expenses either since it s capped at 3 000 for the care of one person and 6 000 for the care of two or more people. In part i of form 2441 report the names of all individuals and organizations you make payments to during the year for care provider services. In this section you will calculate your potential credit limit for irs form 2441. Download blanks on your computer or mobile device.

This is only example for calculation. The iris form 2441 is titled as the child and dependent care expenses which is issued by the department of the treasury internal revenue service of united states of america.

/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png)

/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png)