Form 26as Meaning In Tamil

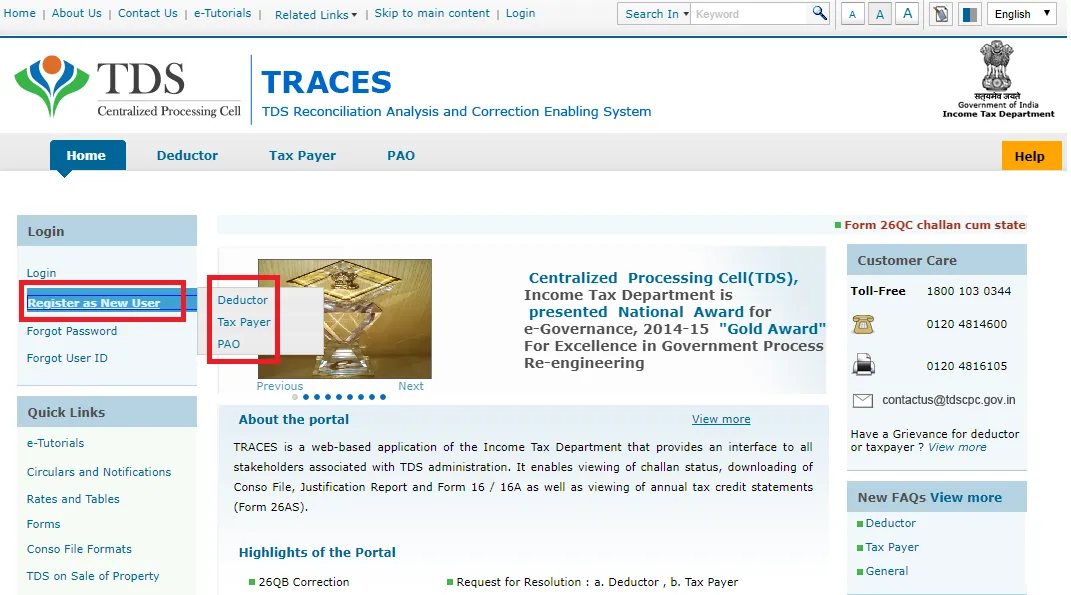

Read the disclaimer click confirm and the user will be redirected to tds cpc portal.

Form 26as meaning in tamil. However the taxpayer is required to verify the details in the form 26as and highlight any discrepancy in the details over underreporting of income or taxes to the tax deductor immediately to make. Form 26as displays various taxes that are deducted from your income by your employer bank or your tenant. Detailed view of form 26as. Form 26as gives an overall view of your income tax deducted in a particular financial year at various sources of income like tax deducted on commission income tax deduction on interest received from fixed deposits tax deducted on salary etc.

The gstr 3b is a simple tax return form introduced by the central board of excise and. For quick alerts allow notifications for daily alerts. The new law came into effect from september 1 2019.

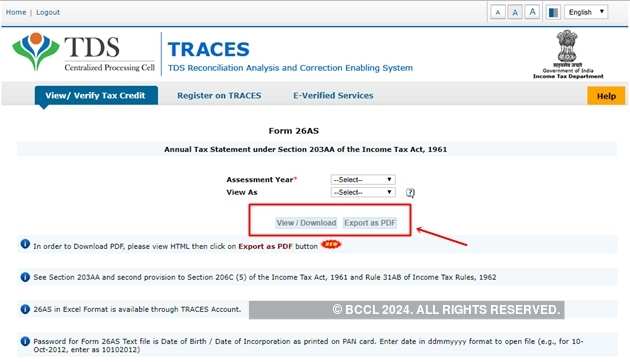

Know more about form 24q 26q 27q 27eq 27d in india. Go to the my account menu click view form 26as tax credit link. Logon to e filing portal www incometaxindiaefiling gov in. Form 26 as is consolidated tax statement form 26as is used as a proof of tax deducted collected on your behalf and the tax directly paid by you along with your income tax return income tax payer is no longer required to attach photocopy of tds certificate along with income tax return.

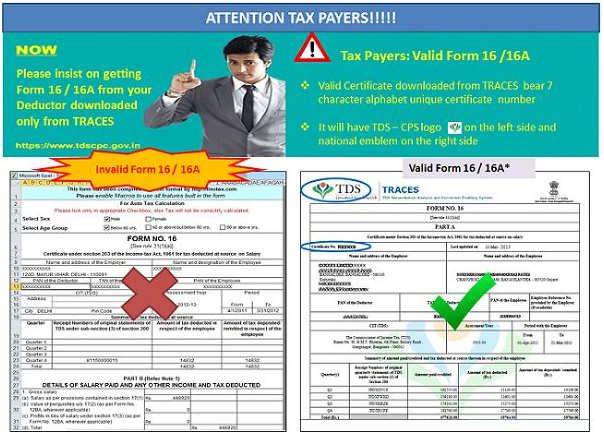

Income tax itr form 26as. 10 things you must know about multiple form 16. A welcome initiative by the income tax department of introduction of form 26as has obviated the need to submit the tds certificates form 16 16a by the tax payer along with the tax return. Perform the following steps to view or download the form 26as from e filing portal.

The details of such tds deducted in the year will also reflect in the individual s form 26as the proposal of levying tds at the rate of two per cent on cash withdrawal over rs 1 crore was announced in the budget of july 2019 by the finance minister. For quick alerts subscribe now இந த ய 719 665 உலகம 11 732 996 view sample. Filing gstr 3b form is mandatory for all those who have registered for the goods and services tax gst. These are the tds forms which an individual needs to fill in order to get the tds returns.