Form 26qb Online Download

Due date to issue form 16b.

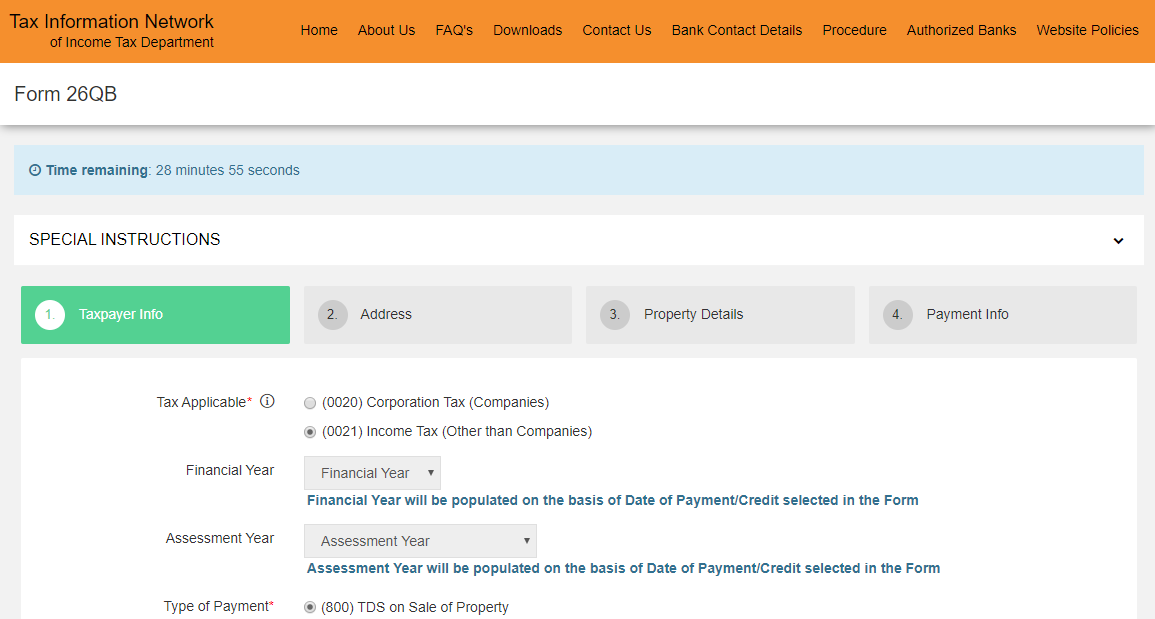

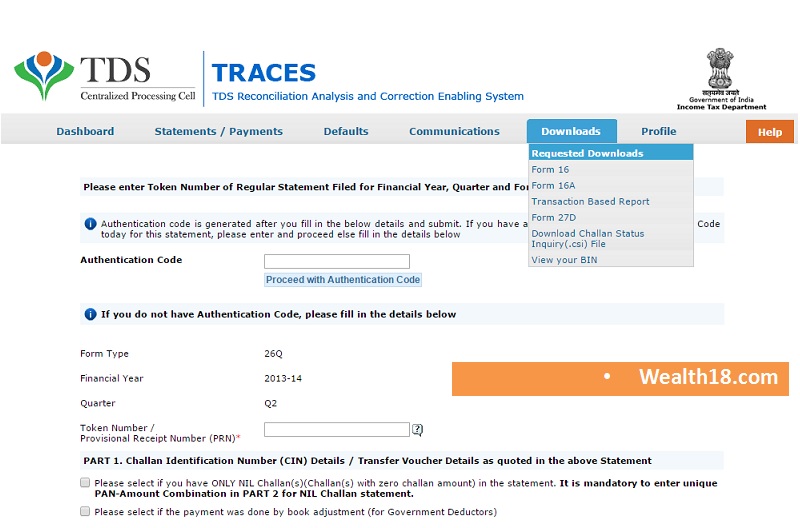

Form 26qb online download. Under tds on sale of property click on online form for furnishing tds on property form 26qb or click here. Assessing officer may levy penalty under section h at his discretion. When requested status will be available click on available status row then click on http download tab to download form 26qb justification report. Payment of demand raised by cpc tds against tds on sale of property.

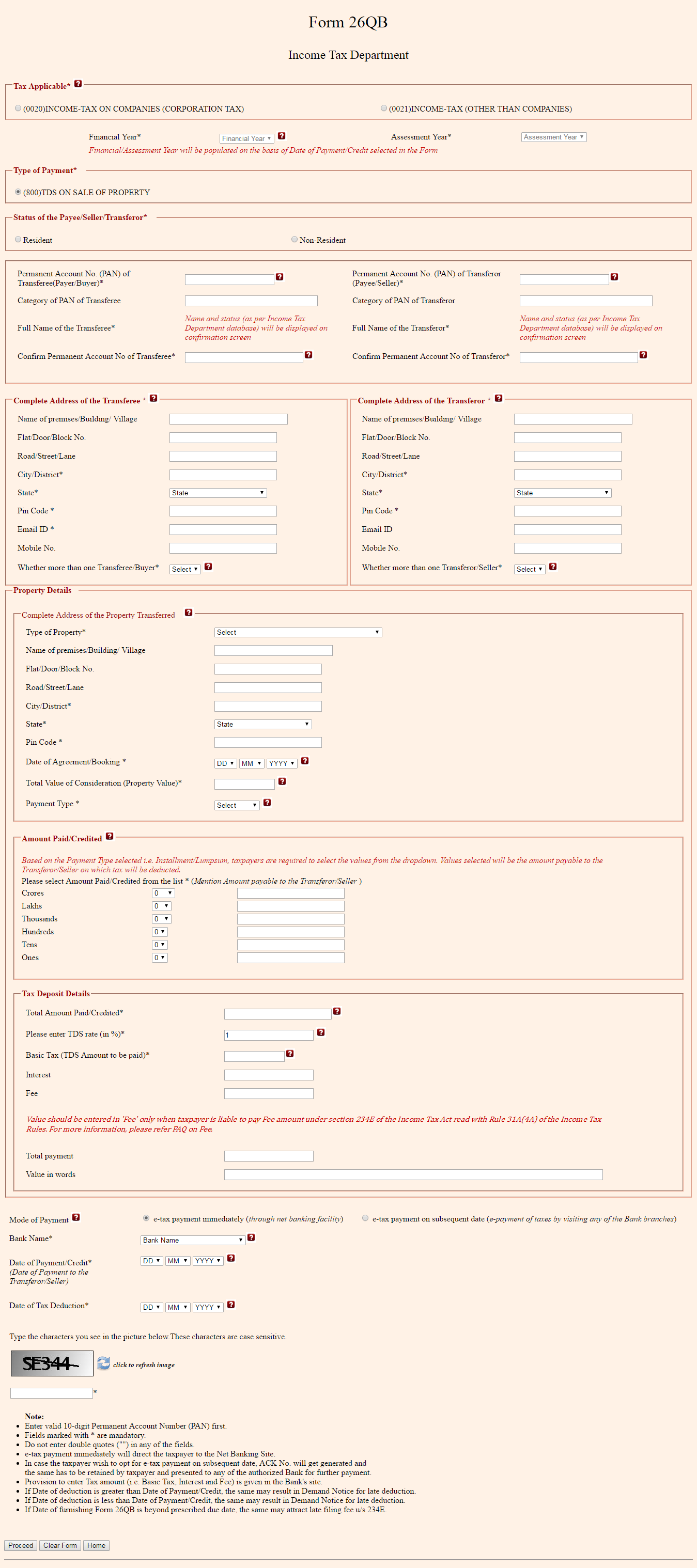

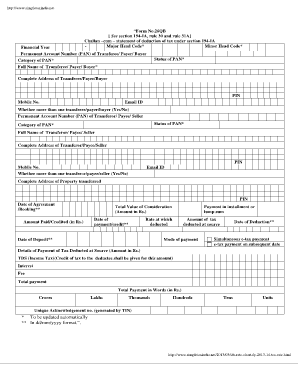

The buyer can download the form after making the tds deposit and filling up the form 26qb. In case of one buyer and two sellers two forms have to be filled in and for two buyers and two seller four forms have to be filled in for respective property shares. Verify deposit of taxes deducted by the purchaser in your form 26as annual tax statement. Form 26qb is a tds certificate for deduct tds on a sale of property equal to or greater than rs.

Demand payment for tds on property. Form 26qb is a return cum challan form for the payment of tax deducted at source tds to the government for deductions made under section 194 ia of the income tax act 1961. Steps to fill form 26qb. Form 26qb is applicable on the purchase of properties after 1 june to find out what qualifies as agricultural land click here.

Enter the password to open zip file of form 26qb justification report. Steps to fill form 26qb. On the home page you will see the tab application for request of form 16b. List of authorized banks for e payment.

Pictorial guide for 26qb justification report. Fill the complete form as applicable. The due date of receiving form 26qb is 30 days from the last day of the. Downloading form 16b or form 26qb.

Challan no itns 285 payment of equalization levy. Once the completed payment in form 26as is shown log in to traces. Select the applicable challan as tds on sale of property. The deductor or the buyer of the property has to issue form 16b to the seller or the deductee within 15 days after the due date of receiving form 26qb.

Form 26qb payment of tds on sale of property. Online statement cum challan form form 26qb is to be filled in by each buyer for unique buyer seller combination for respective share. Select the application for request of form 26qb to download the same. Challan no itns 286 payment under income declaration scheme 2016.

Click on that tab to download it. This section of the act specifically deals with transactions involving the sale of immovable property and the applicable tds along with form 26qb needs to be submitted within 30 days counted from the end of the month in.