Form Td1mb Ws

Caregivers are required to complete a registration form submit a copy of the form to manitoba finance and continue to claim the credit on the income tax return.

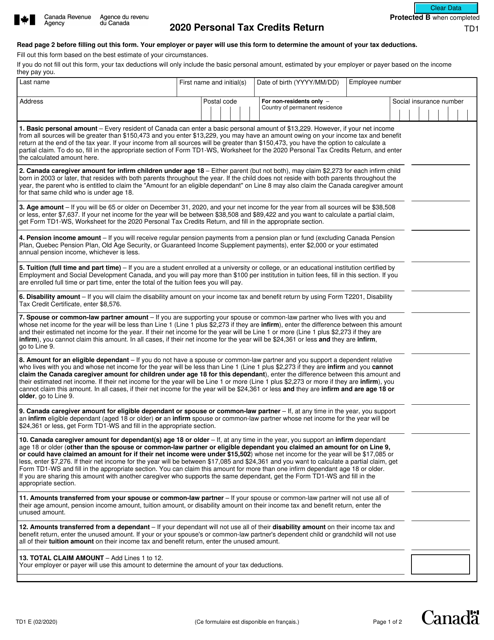

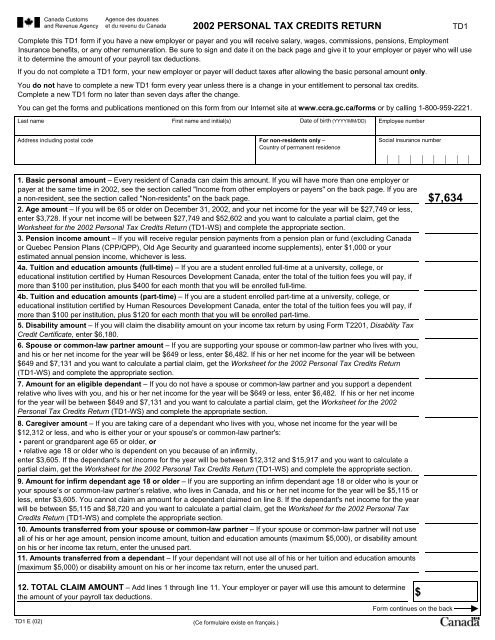

Form td1mb ws. Pdf td1mb ws 20e pdf pdf fillable saveable td1mb ws fill 20e pdf. Complete this form if you are a reserve force member who is a cfsa annuitant as a result of prior regular force service and wish to exercise an early contribution option thereby surrendering the right to an existing cfsa annuity entitlement. Keep it for your records. Form td1mb ws and fill in the appropriate section.

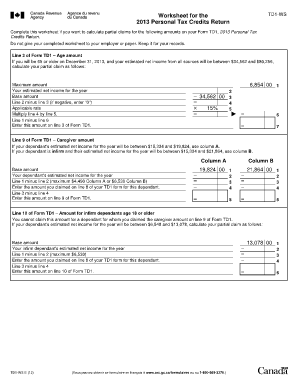

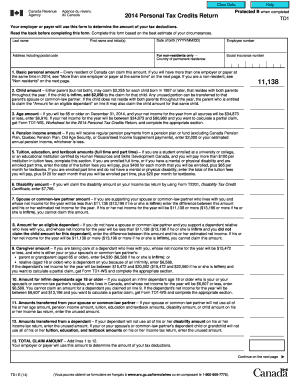

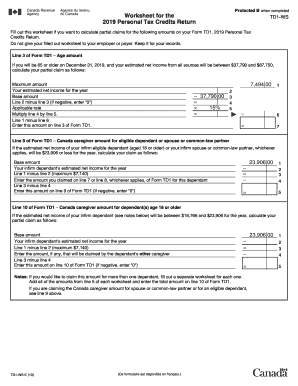

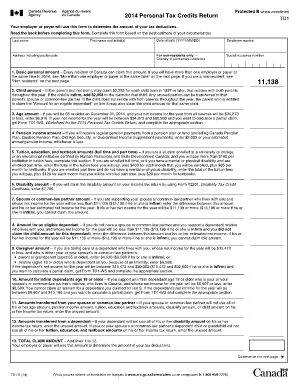

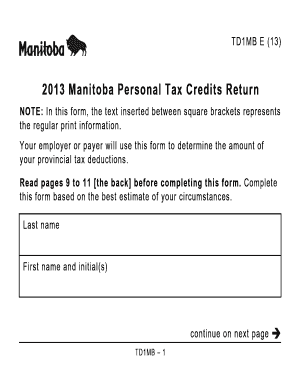

Form td1mb ws worksheet for the 2019 manitoba personal tax credits return and fill in the appropriate section. Td1mb ws worksheet for the 2019 manitoba personal tax credits return. These forms can be obtained on the canada revenue agency cra td1 forms web page. Td1mb ws e 13 vous pouvez obtenir ce formulaire en français à www arc cra gc ca ou en composant le 1 800 959 3376 worksheet for the 2013 manitoba personal tax credits return complete this worksheet if you want to calculate partial claims for the following amounts on form td1mb 2013 manitoba personal tax credits return.

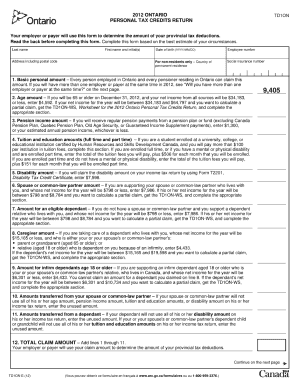

Amount for infirm dependants age 18 or older if you are supporting an infirm dependant aged 18 or older who is your or your spouse s or common law partner s relative who lives in canada and whose net income for the year will be 5 115 or less enter 3 605. Every taxpayer should ensure that they have completed the td1mb and td1mb ws personal tax credits return forms for their employer in order to ensure the family tax benefit is used to reduce withholding taxes during the year. Amount for infirm dependants age 18 or older if you are supporting an infirm dependant aged 18 or older who is your or your spouse s or common law partner s relative who lives in canada and whose net income for the year will be 5 115 or less enter 3 605. I think that is the primary difference where you say 15 100 and i calculated 12 455.

With her income approximately 31 000 net i calculated this row as approximately 450 i don t have the exact number in front of me right now. Amount for infirm dependents age 18 or older if you are supporting an infirm dependant aged 18 or older who is your or your spouse s or common law partner s relative who lives in canada and whose net income for the year will be 5 115 or less enter 3 605. For best results download and open this form in adobe reader. Line 2 of form td1mb age amount.

Form td1mb ws and complete the appropriate section. Form td1mb ws and fill in the appropriate section. The primary caregiver tax credit is a flat 1 400 annual credit available to all caregivers. You can view this form in.

Do not give your filled out worksheet to your employer or payer.