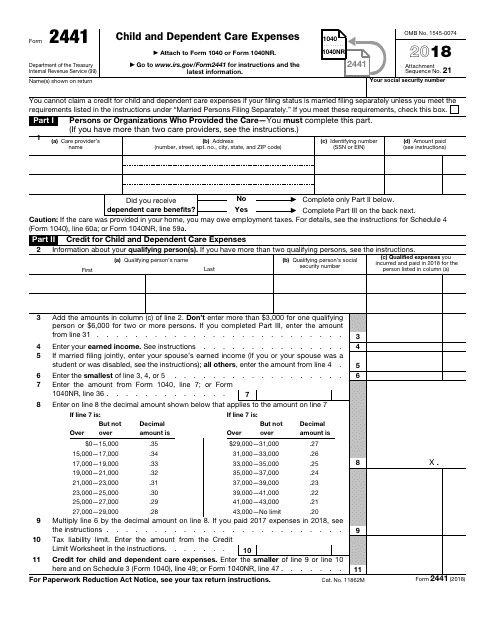

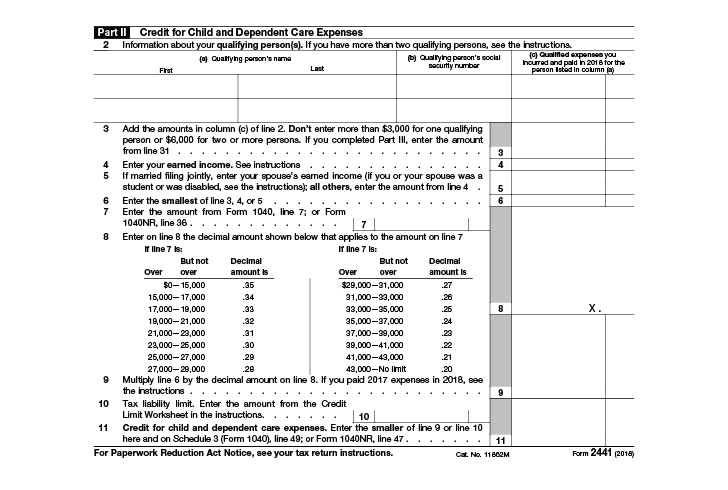

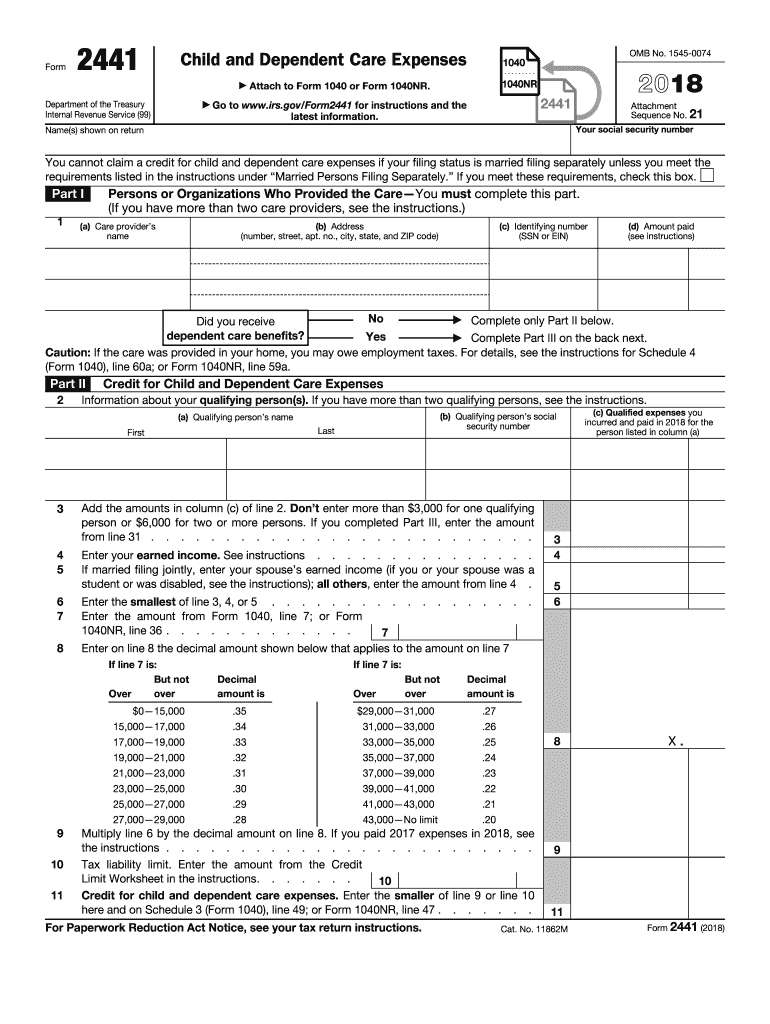

Irs Form 2441 Instructions 2019

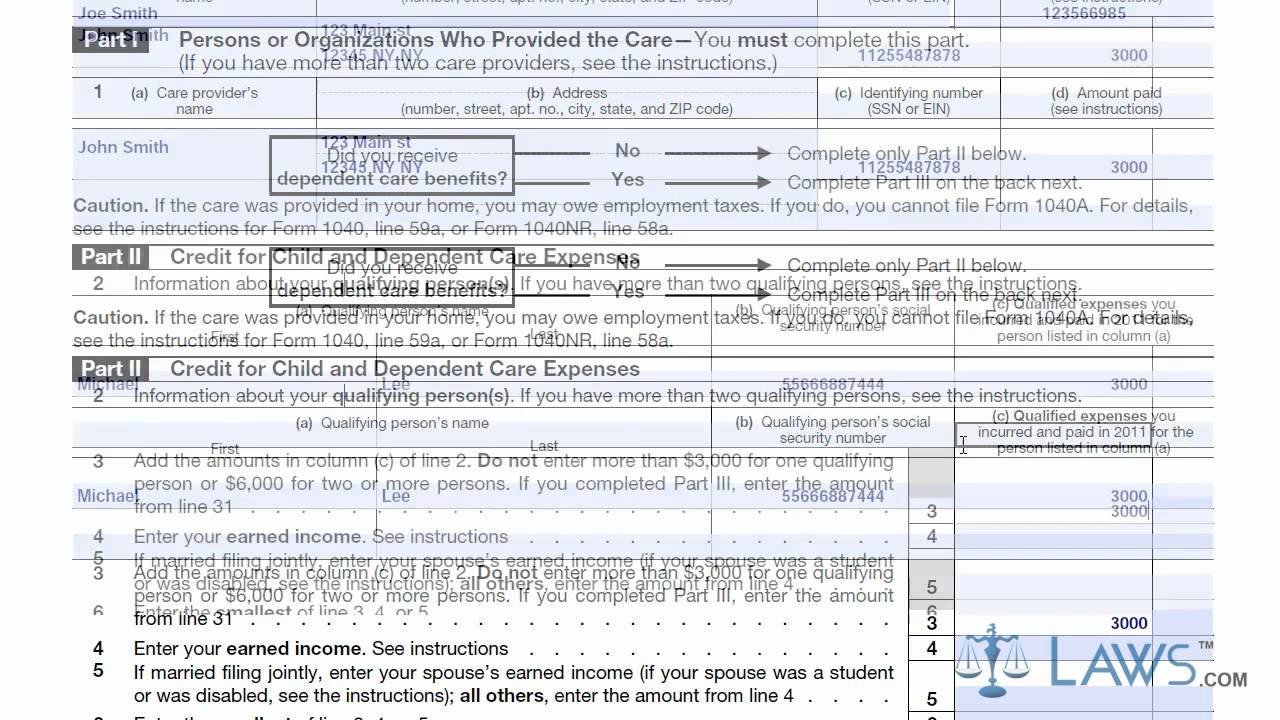

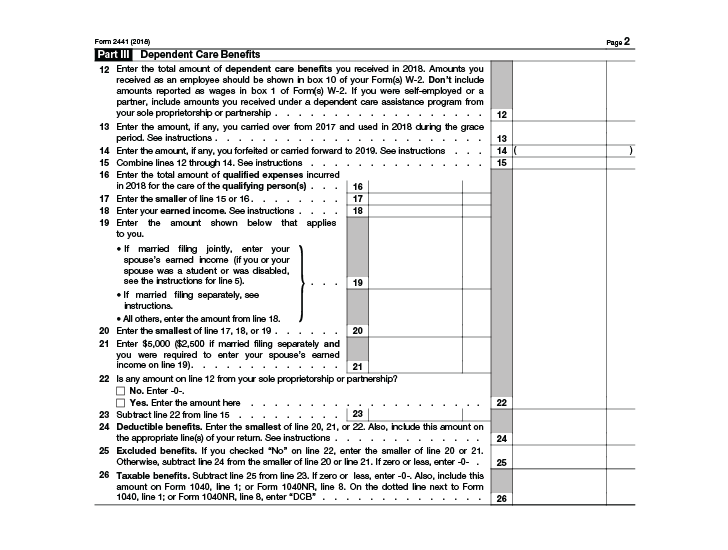

Amounts you received as an employee should be shown in box 10 of your form s w 2.

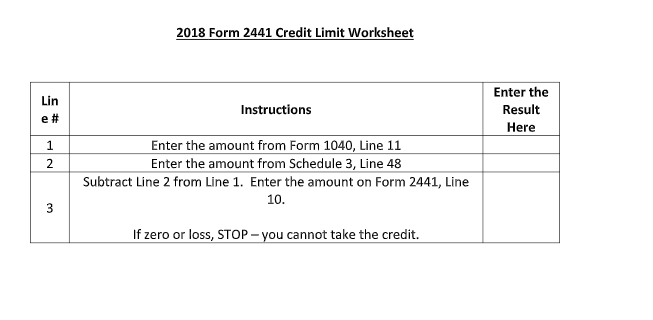

Irs form 2441 instructions 2019. When saving or printing a file be sure to use the functionality of adobe reader rather than your web browser. Name s shown on return. 2019 instructions for form 2441 child and dependent care expenses department of the treasury internal revenue service reminder married persons filing separately checkbox. Irs form 2441 instructions 2019.

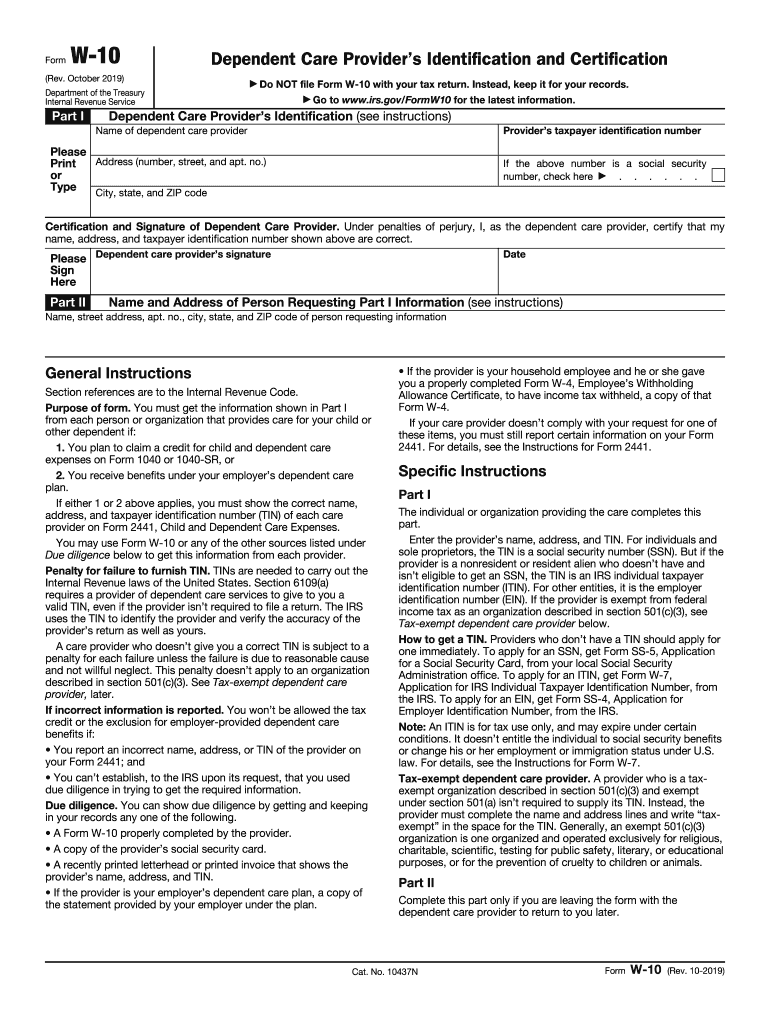

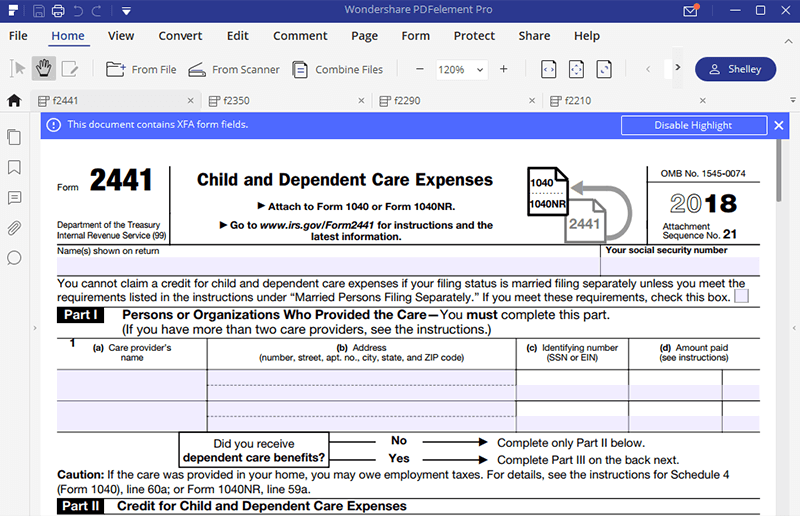

Information put and request legally binding digital signatures. For paperwork reduction act notice see your tax return instructions. Secure and trusted digital platform. You cannot claim a credit for child and dependent care expenses if your filing status is married filing separately unless you meet the requirements listed in the instructions under married persons filing separately.

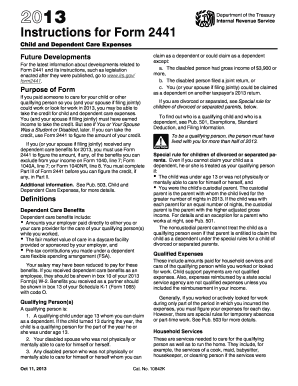

Your social security number. Editable irs instruction 2441 2019. Taxpayers file form 2441 with form 1040 to determine the amount of their available dependent care tax credit dctc and dcap participants must file it with form 1040 to support the income exclusion for their dcap reimbursements. Child and dependent care expenses 2017 inst 2441.

Generally married persons must file a joint return to claim the credit. Complete sign print and send your tax documents easily with us legal forms. Download blank or fill out online in pdf format. 2019 federal tax forms and instructions for form 2441 we recommend using the most recent version of adobe reader available free from adobe s website.

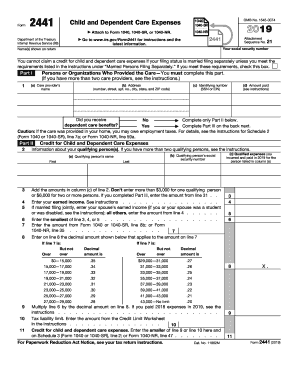

Turn them into templates for numerous use add fillable fields to collect recipients. Reap the benefits of a electronic solution to develop edit and sign documents in pdf or word format online. 9 11 form 2441 2019 page 2 form 2441 2019 part iii dependent care benefits 12 enter the total amount of dependent care benefits you received in 2019. Irs form 2441 2019.

Work from any device and share docs by email or fax. Reap the benefits of a digital solution to develop edit and sign contracts in pdf or word format on the web. Application for enrollment to practice before the internal revenue service 1119 11 01 2019 form 56. Information put and request legally binding electronic signatures.

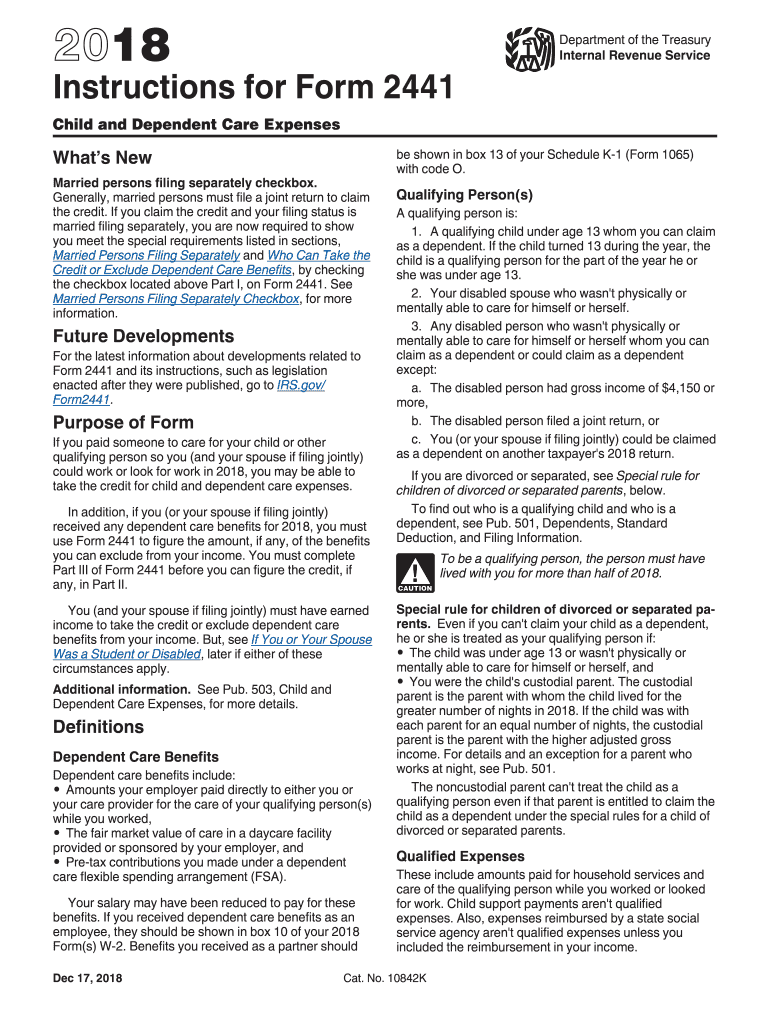

Instructions for form 2441 child and dependent care expenses 2017 form 2441. If you claim the credit and your filing status is. Turn them into templates for numerous use insert fillable fields to collect recipients. Notice concerning fiduciary relationship 1219 05 20 2020 inst 56.

The irs has released form 2441 child and dependent care expenses and its accompanying instructions for the 2019 tax year. Child and dependent care expenses 2018 inst 2441.

/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png)

/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png)