Irs Form 2848 Withdrawal

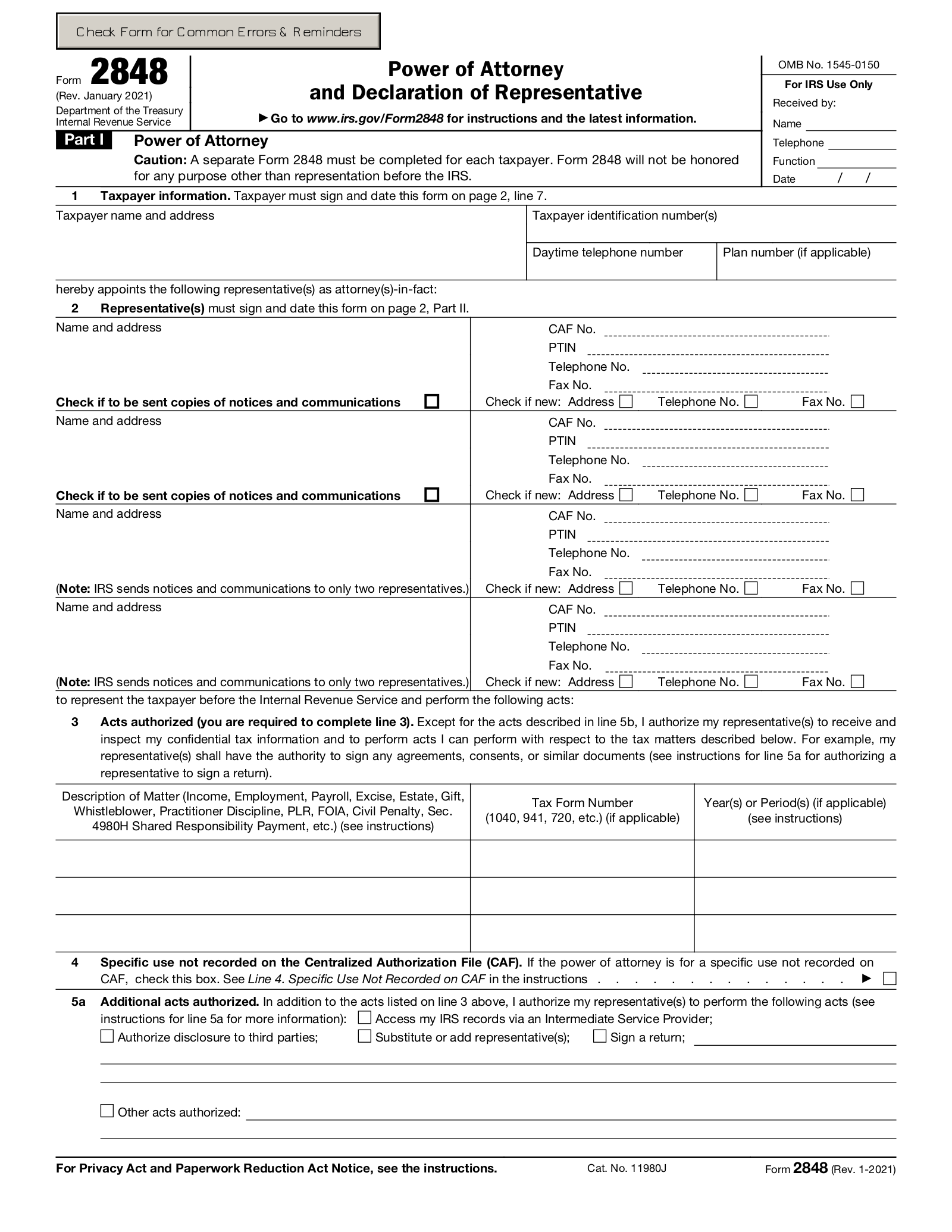

Information about form 2848 power of attorney and declaration of representative including recent updates related forms and instructions on how to file.

Irs form 2848 withdrawal. The irs will accept a power of attorney other than form 2848 provided the document satisfies the requirements for a power of attorney. Tax return preparer. Substitute to form 2848. Irs a statement of withdrawal that indicates the authority of the power of attorney is withdrawn lists the matters and years periods and lists the name tin and address if known of the taxpayer.

You can also file a new form 2848. Substitute form 2848 the irs will accept a power of attorney other than form 2848. The statement of revocation or withdrawal must indicate that the authority of the power of attorney is revoked list the tax matters and periods and must be signed and dated by the taxpayer or representative. Practitioners may withdraw an authorization at any time.

If you need to file a form 2848 with the irs community tax has the tools and resources to assist you. If you need to revoke an irs power of attorney agreement or withdraw a representative you must write revoke across the top of the first page with a current signature and date below the annotation. If you do not have a copy of the power of attorney you want to revoke or withdraw send a statement to the irs. Irs form 2848 is used to designate an individual to represent the taxpayer before the irs and to allow the representative to perform all tax acts that the taxpayer would normally take care of form 2848 is used to file for irs power of attorney.

The representative must sign and date this statement. Withdrawing form 2848 or 8821 authorization. 216 conference and practice requirements section 601 503 a. Representatives are listed and must complete part 2 of the.

These alternative powers of attorney cannot however be recorded on the caf unless you attach a completed form 2848. The person authorized in this filing must be an eligible. Form 2848 sp power of attorney and declaration of representative spanish version instructions for form 2848 sp. This form is used by the taxpayer to authorize an individual to represent them before the irs.

Form 2848 is used to authorize an eligible individual to represent another person before the irs. Publication 947 practice before the irs and power of attorney authorizing a representative revocation of power of attorney withdrawal of representative. Revocation of poa withdrawal of representative. Write revoke across the top of form 2848.

/2848POAandDeclarationofRepresentative-1-abe9639bbc8f4daf86889da0803dce58.png)