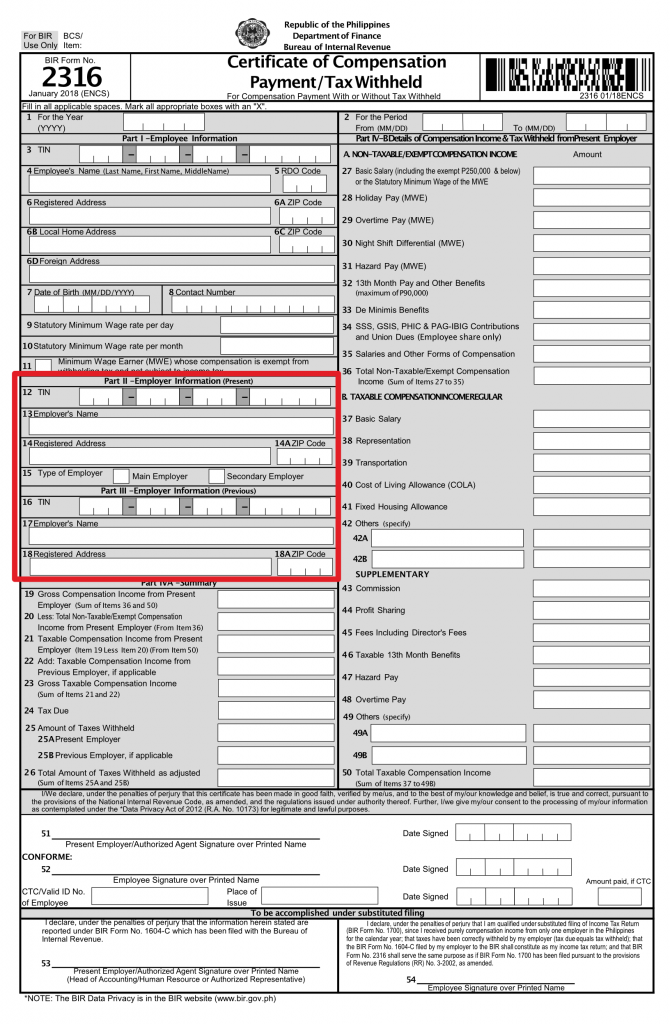

Itr Form 2316 Sample

Start a free trial now to save yourself time and money.

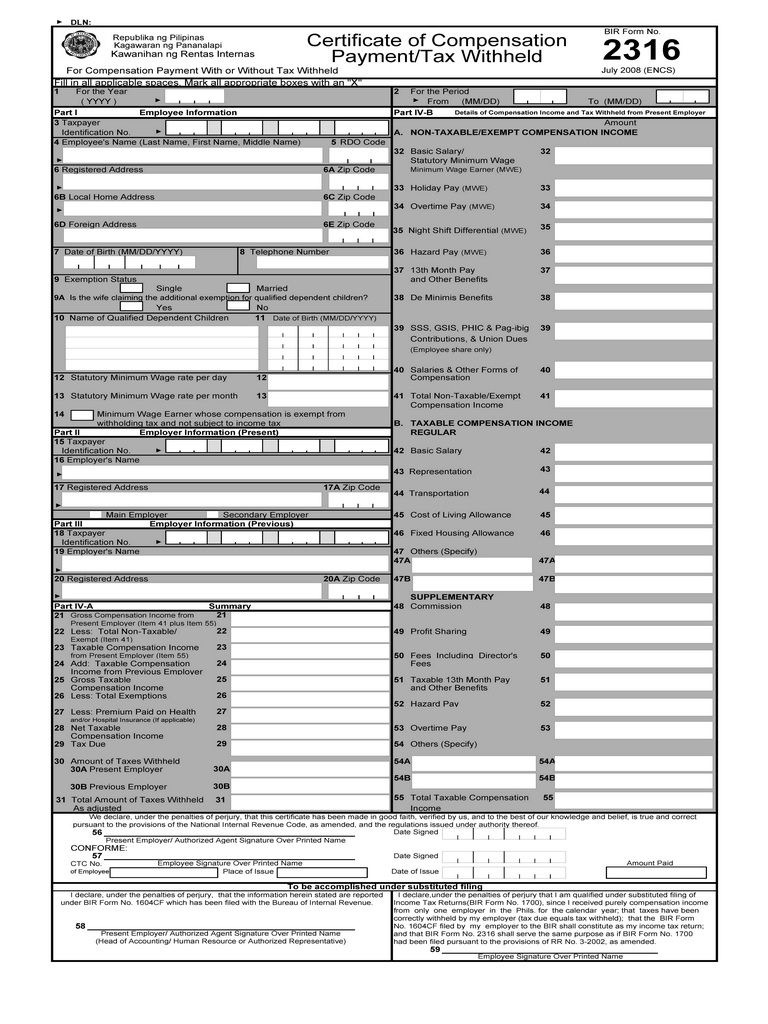

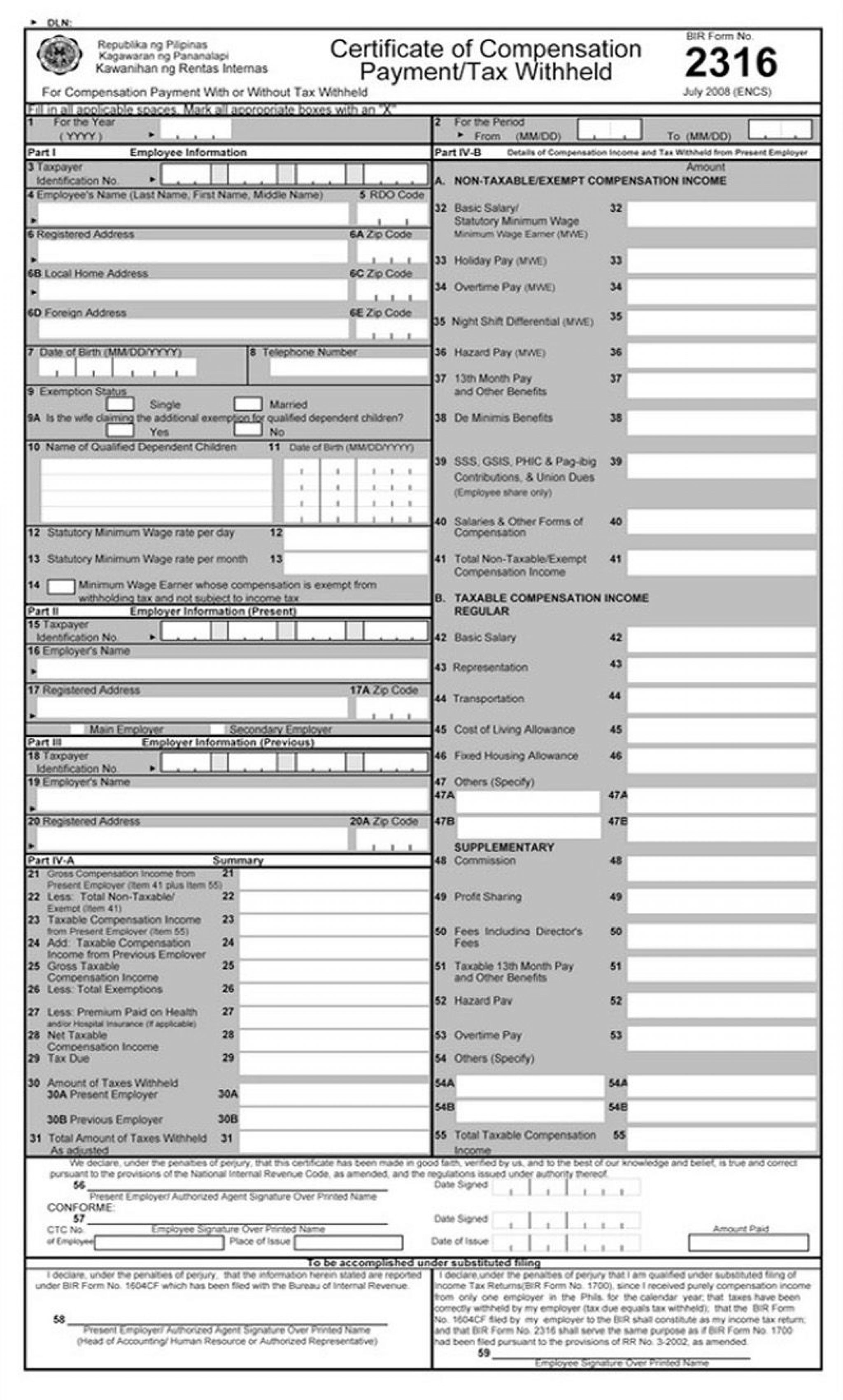

Itr form 2316 sample. 2316 shall serve the same purpose as if bir form no. Itr 2316 form filing. Typical tax computation for 2020 assumptions. Where the data of the return of income in form itr 1 sahaj itr 2 itr 3 itr4 sugam itr 5 itr 6 itr 7 filed and verified of printing at government of india press ring road mayapuri new delhi 110064 and published by the controller of publications delhi 110054.

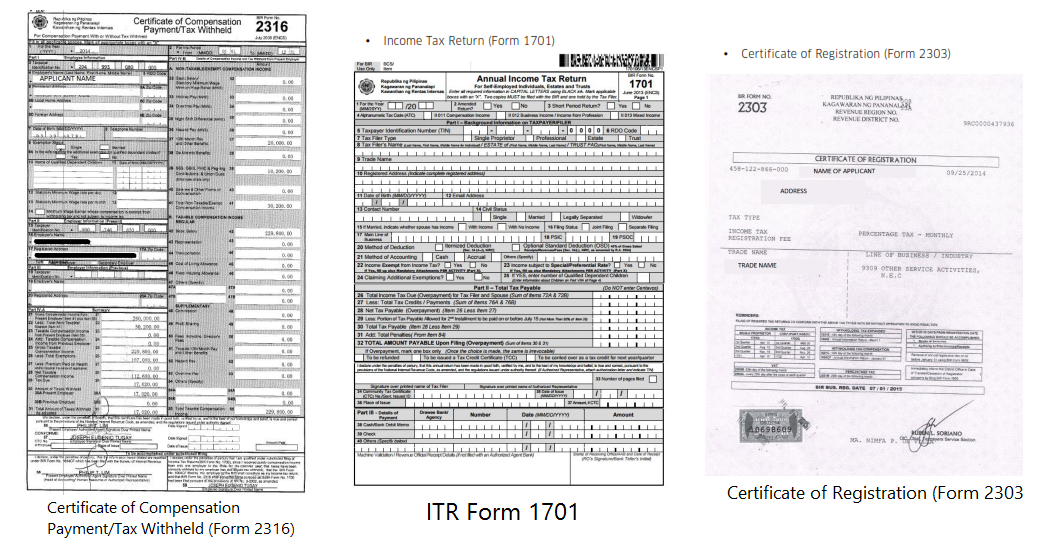

For ewt this certificate in turn should be attached to the quarterly annual income tax return bir forms 1701q 1701 for individuals or bir form 1702q 1702 for non individuals in which case the amount of withholding tax shall be allowed as a tax credit against the income tax liability of the income recipient in the taxable quarter or year in which the income was earned or received. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Hi i am employed of the company but i my company will not deduct my salary because of my minumum wage but for now i need to get itr or 2316 form for my turist visa and loan requirements my question if i request to my comany to have a itr or 2316 form the compy release itr to me thank you. Salary of php 652 000 living allowances of php 100 000 and housing benefits 100 of php 300 000.

27 c and other special laws with no other taxable income. What is bir form 2316. Promotion pnp afp loans video of itr 2316 form. Annual income tax return for corporation partnership and other non individual taxpayer subject only to regular income tax rate.

Resident alien husband and wife with two dependent children. 1700 had been filed pursuant to the provisions of rr no. The bir form 2316 must be attached to the annual income tax return which is the bir form 1700 for individuals receiving purely compensation income or bir form 1701 for individuals with mixed income. Available for pc ios and android.

Salary and allowances of husband arising from employment. 1604cf filed by my employer to the bir shall constitute as my income tax return and that bir form no. Substituted filing of itr simply referred to as substituted filing is when the filing of certificate of compensation payment and tax withheld bir form 2316 done by the employer of an individual taxpayer can become a substitute to the filing of the annual income tax return for individuals earning purely compensation income bir form no. Annual income tax return for corporation partnership and other non individual taxpayers exempt under the tax code as amended sec.

Bir form 2316 is a statement signed by both the employee and the employer and serves the same purpose as if bir form no. For the calendar year that taxes have been correctly withheld by my employer tax due equals tax withheld that the bir form no.