Ny Form Ct 13 Instructions

Corporations liable for tax under tax law article 9 a.

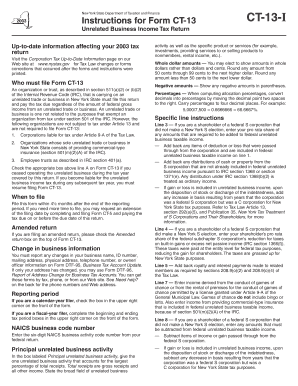

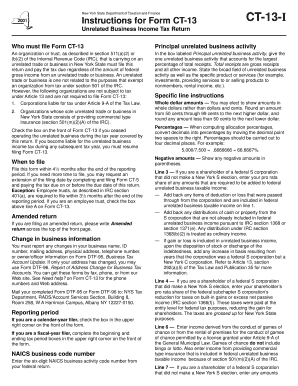

Ny form ct 13 instructions. This form is for income earned in tax year 2019 with tax returns due in april 2020 we will update this page with a new version of the form for 2021 as soon as it is made available by the new york government. 400001180094 250 00 page 2 of 3 ct 13 2018 have you been audited by the internal revenue service in the past 5 years yes federal return was filed on 990 t other if yes list years attach a complete copy of your federal return. New york state department of taxation and finance instructions for form ct 13 unrelated business income tax return important reminder to file a complete return. Mark an x in the appropriate box above line a on form ct 13 if you ceased operating the unrelated business during the tax year.

This is a good start 2019 new york form ct 13 instructions form and instructions printable new york state nys in e tax form it 201 must be postmarked by april 17 2018 in order to avoid penalties and late fees new york tax forms 2017 printable new york state nys it. Ct 13 2018 2019 form see section who must file form ct 13 in the instructions. Organizations whose sole unrelated trade or business in new york state consists of providing commercial type insurance irc section 501 m 2 a. You can help bring these children home by looking at the photographs and calling 1 800 the lost 1 800 843 5678 if you recognize a child.

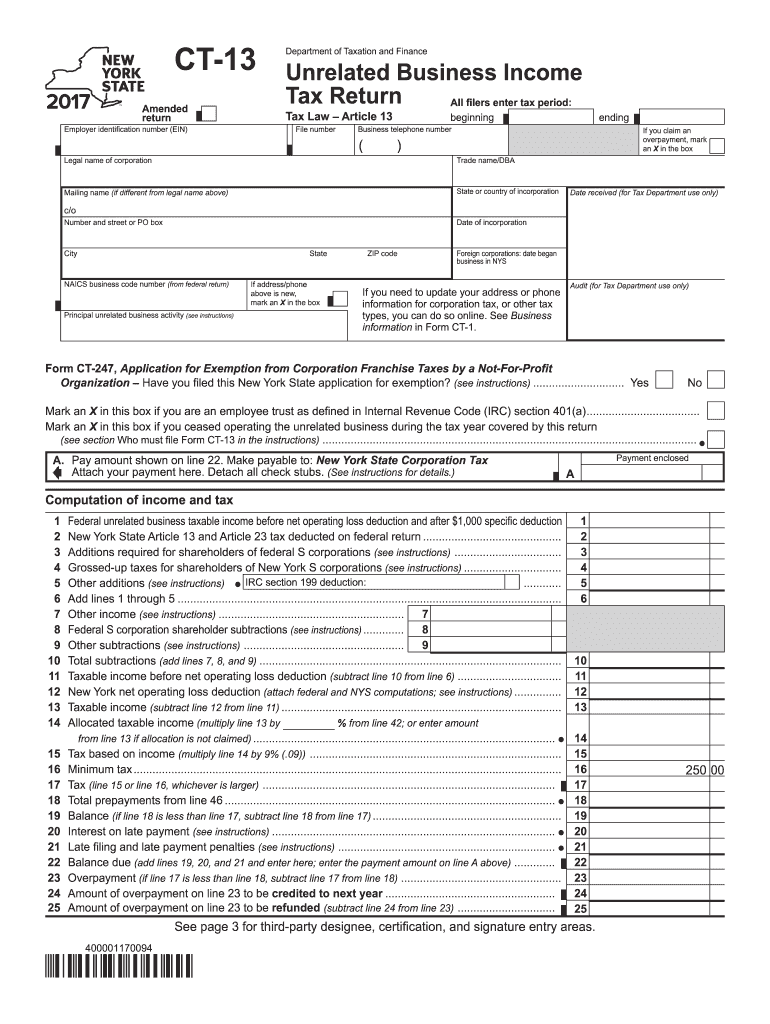

Tax law article 13 employer identification number ein file number legal name of corporation mailing name if different from legal name above c o city beginning business. Nyc 399 schedule of new york city depreciation adjustments nyc 399z depreciation adjustments for certain post 9 10 01 property nyc 400 for 2020 estimated tax by business corporations and subchapter s general corporations. Instructions for form ct 225 and ct 225 a i instructions for forms ct 225 a and ct 225 a b decouple from irc federal basis for new york state manufacturing test for tax years beginning on or after january 1 2018 the test for determining whether a manufacturer is a qualified newyork manufacturer changed from using federal. See section who must file form ct 13 in the instructions.

Pay amount shown on line 22. We last updated new york form ct 13 in february 2020 from the new york department of taxation and finance. You must complete all required schedules and forms that make up your return and include all pages of those forms and schedules when you file. Instructions on pages that would otherwise be blank.

Pay amount shown on line 22. General instructions purpose of form ct 1 these instructions give you some background information about form ct 1. Make payable to new york state corporation tax attach your payment sarc word 10 11 lewis center for educational research.