Ny Form Ct 3

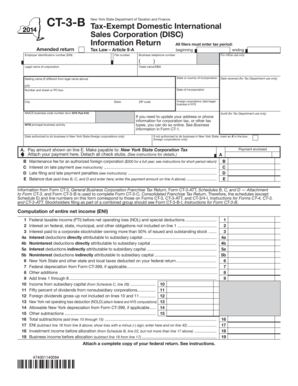

Ct 3 1 i instructions investment and other exempt income and investment capital.

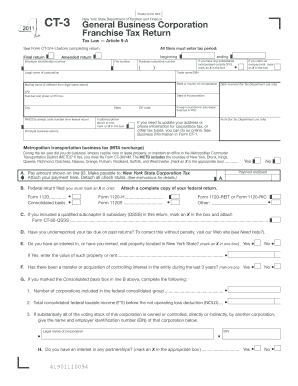

Ny form ct 3. We last updated new york form ct 3 s in february 2020 from the new york department of taxation and finance. This form is for income earned in tax year 2019 with tax returns due in april 2020 we will update this page with a new version of the form for 2021 as soon as it is made available by the new york government. Code date see instructions for where to file. Form ct 3 s new york s corporation franchise tax return duration.

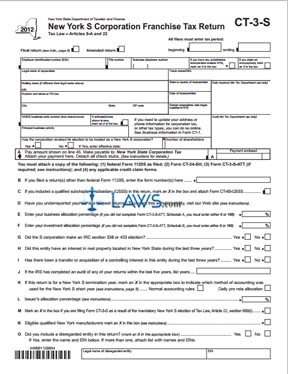

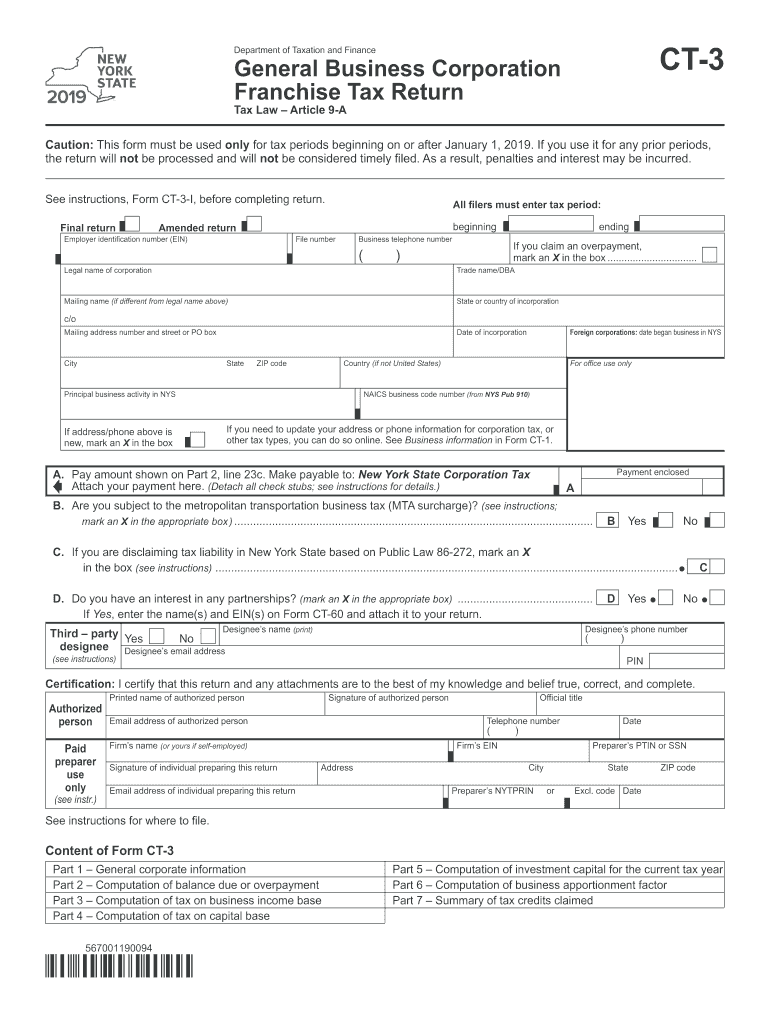

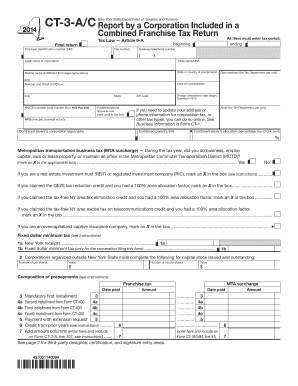

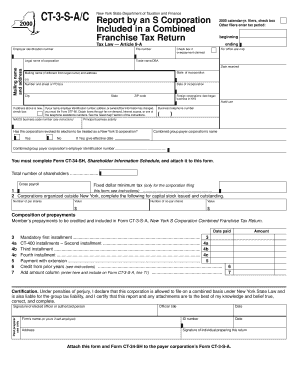

New york general business corporation franchise tax return ct 3 step 3. Attachment to form ct 3 s obsolete form ct 3 s att 2014 attachment to form ct 3 s ct3satt new york state department of taxation and finance attachment to form ct 3 s legal name of corporation ct 3 s att employer identification number attach to form ct 3 s new york s corporation franchise tax return. How to pay off your mortgage fast using velocity banking how to pay off your mortgage. Ct 3 2 i instructions subtraction modification for qualified banks.

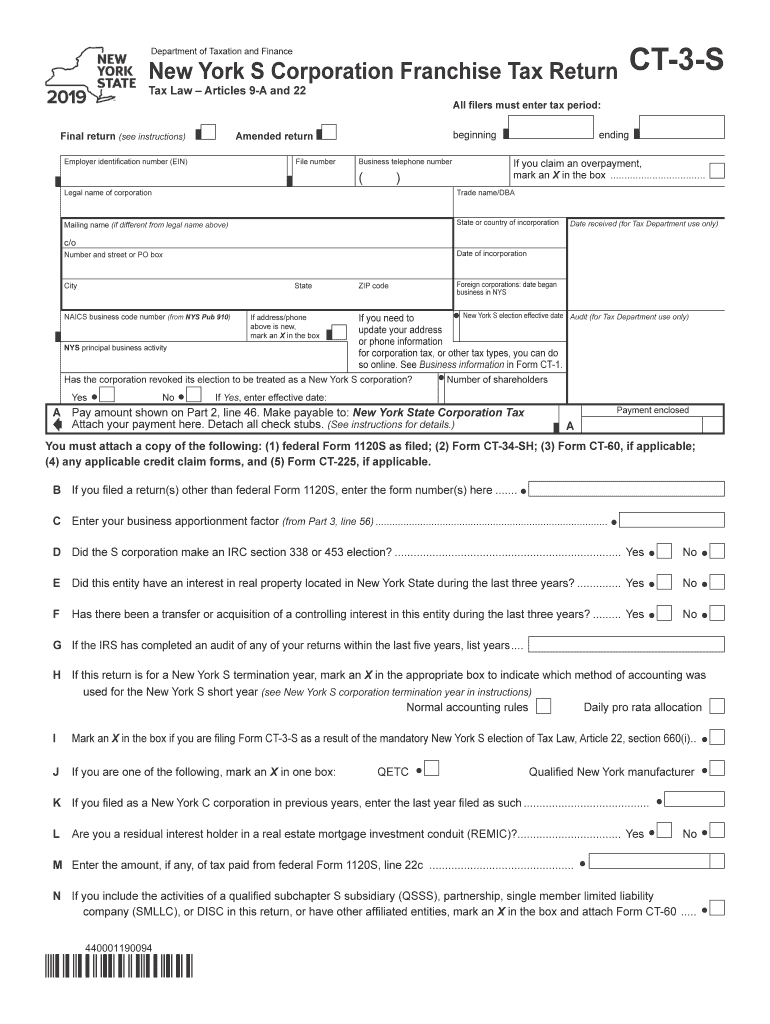

New york s corporation franchise tax return form ct 3 s 2019 new york s corporation franchise tax return ct3s department of taxation and finance new york s corporation franchise tax return tax law articles 9 a and 22 final return see instructions all filers must enter tax period. To complete form ny ct 3 3 schedule a lines 1 and 2 do the following. Indicate with a check mark if you operated in an area subject to the mta tax. Due to the ny corporate tax law revisions beginning january 1 2015 atx cannot auto populate these fields in the return.

If so you must also file form ct 3m 4m. Ct 3 3 i instructions prior net operating loss conversion pnolc. New york s corporation franchise tax return form ct 3 s s corporations doing business in new york must file their franchise taxes using a form ct 3 s. The document is found on the website of the new york state department of taxation and finance.

New york general business corporation franchise tax return ct 3 step 4. Answer the questions on lines b through h. Ct 3 a i instructions general business corporation combined franchise tax return ct 3 1. This can be used to submit an initial amended or final return.

Ein date preparer s ptin or ssn city preparer s nytprin state or zip code excl. 567002190094 page 2 of 8 ct 3 2019 part 1 general corporate information section b new york state information see instructions section c filing information 1a qualified emerging technology company qetc for purposes of the lower tax rates capital base tax cap and fixed dollar minimum tax amounts.