Ny Form It 204 Ll Instructions 2019

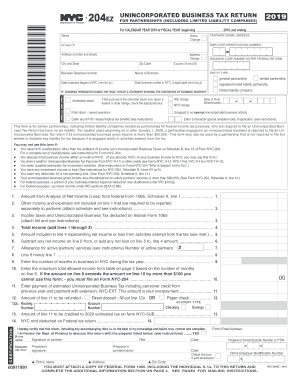

Instructions for form nyc 204 unincorporated business tax return for partnerships including limited liability companies 2019 for details on the proper reporting of income and expenses addressed in the federal tax cuts and jobs act of 2017 such as the irc section 163 j limitation on the business interest expense deduction foreign derived intangible in.

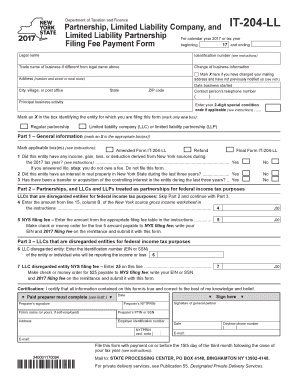

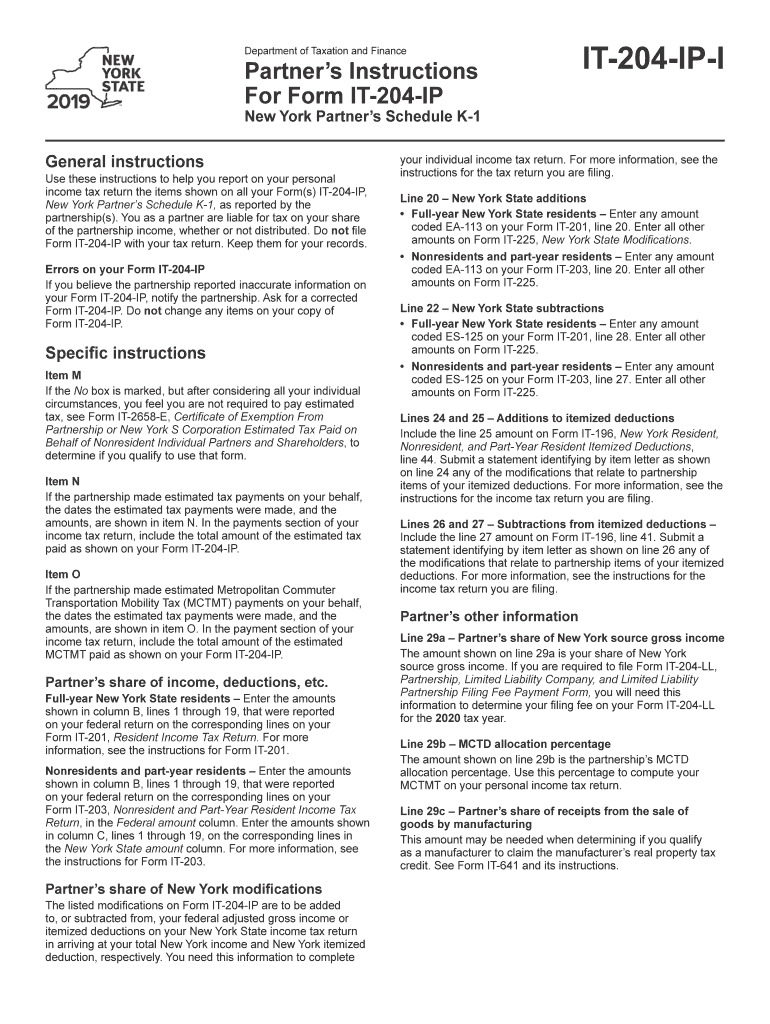

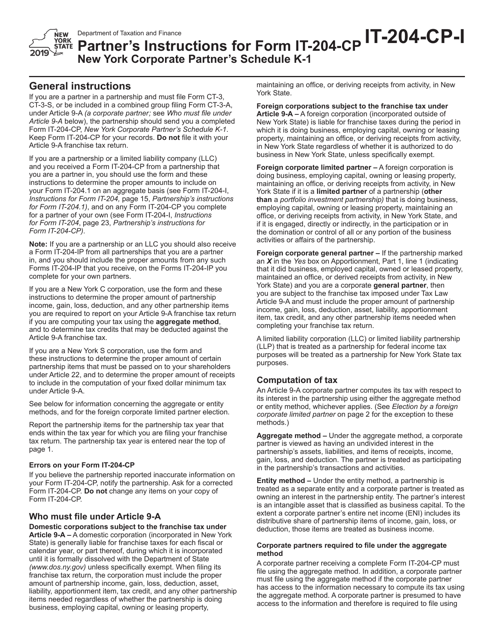

Ny form it 204 ll instructions 2019. Instructions for form it 204 it 204 i 2019 page 3 of 28 other forms you may have to be added to or subtracted from the partners federal adjusted file form it 204 ll partnership limited liability company and limited liability partnership filing fee payment form you must file form it 204 ll and pay a new york state filing fee if you are. Partnership limited liability company and it 204 ll limited liability partnership for calendar year 2019 or tax year beginning 19 and ending filing fee payment form department of taxation and finance legal name identification number see instructions trade name of business if different from legal name above change of business information address number and street or rural route mark x. Click on new york smllc it 204 ll from the left navigation pane. This form is for income earned in tax year 2019 with tax returns due in april 2020 we will update this page with a new version of the form for 2021 as soon as it is made available by the new york government.

Returns for calendar year 2019 are due march 16 2020. Form it 204 ll will not generate if the box no income gain loss deduction from ny sources is checked. Instructions for form it 204 file a new york state partnership return using form it 204. We last updated new york form it 204 ll in january 2020 from the new york department of taxation and finance.

Complete the rest of this screen as necessary. Shown on line 29a is your share of new york source gross income. This will take you to screen 54 098. Free printable 2019 new york form it 201 and 2019 new york form it 201 instructions booklet in pdf format to print fill in and mail your state income tax return due july 15 2020.

2019 new york source gross income. Check the box llc disregarded entity mandatory. Form it 204 ll partnership limited liability company and limited.