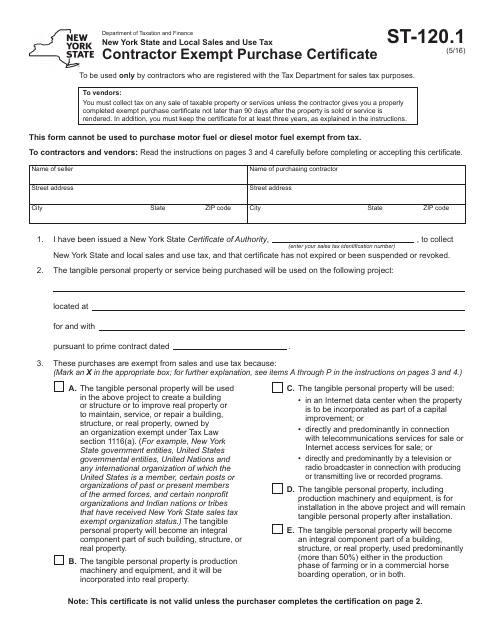

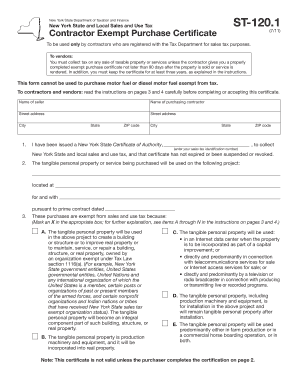

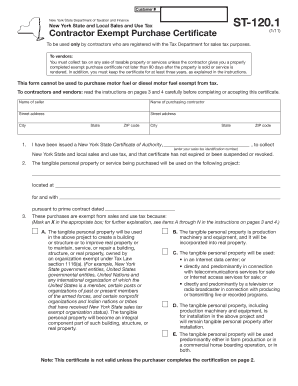

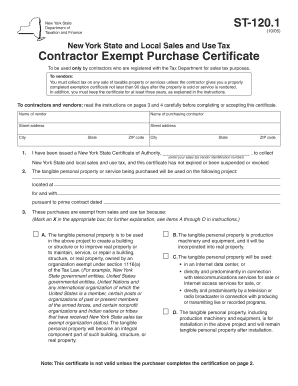

Ny Form St 120 1

You must collect tax on a sale of taxable property or services unless the contractor gives you a properly completed exemption certificate not later.

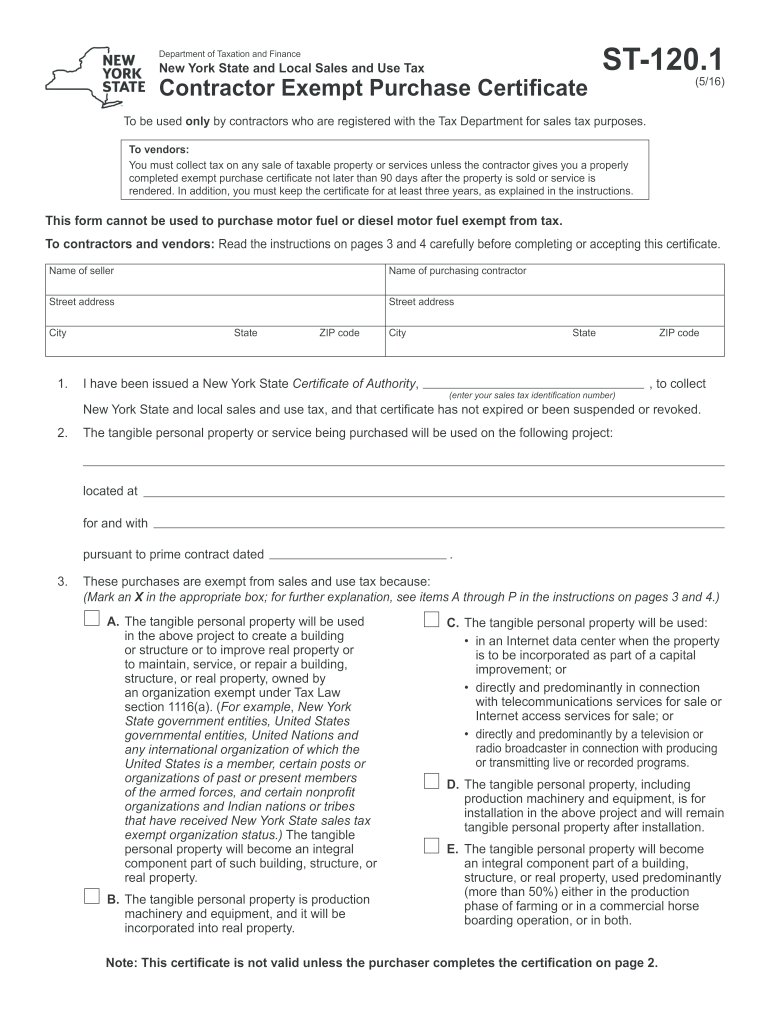

Ny form st 120 1. New york state department of taxation and finance resale certificate. Form st 120 resale certificate is a sales tax exemption. The tangible personal property or service being purchased will be used on the following project. The st 119 1 fillable form is available for.

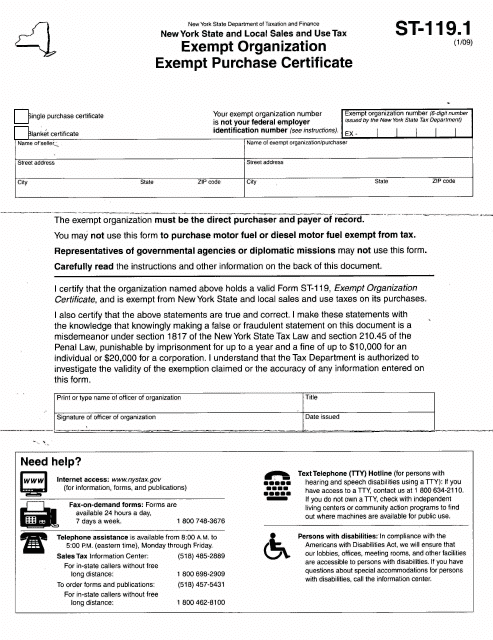

For example new york state government entities united states. Part 1 should indicate you are a new york state vendor and include your certificate of authority number. Form st 119 1 new york state and local sales and use tax exempt organization exempt purchase certificate is a document that enables you to make tax free purchases of products usually subject to sales tax. Located at for and with pursuant to prime contract dated.

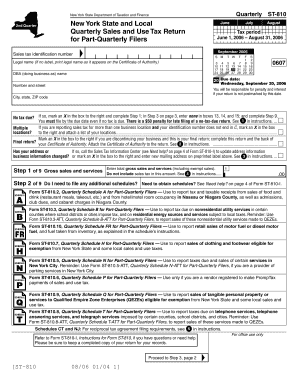

Sign and date the form. New york state department of taxation and finance st 120 1 2 98 to contractors and vendors. New york state department of taxation and finance new york state and local sales and use tax resale certificate mark an x in the appropriate box. New york state and local sales and use tax and that certificate has not expired or been suspended or revoked.

Single use certificate blanket certificate temporary vendors must issue a single use certificate. St 120 1 new york state department of taxation and finance new york state and local sales and use tax contractor exempt purchase certificate 1 11 to be used only by contractors who are registered with the tax department for sales tax purposes. C issue form st 120 1 contractors exempt purchase certificate if the tangible personal property being purchased qualifies for. Print your name and title.

The tangible personal property will be used. For example new york state government entities united states. New york state and local sales and use tax resale certificate. Read the instructions on the back carefully before completing or accepting this certificate.

If you need more information please consult the new york state department of taxation and finance. The tangible personal property will be used in the above project to create a building or structure or to improve real property or to maintain service or repair a building structure or real property owned by an organization exempt under tax law section 1116 a. The tangible personal property will be used in the above project to create a building or structure or to improve real property or to maintain service or repair a building structure or real property owned by an organization exempt under tax law section 1116 a.