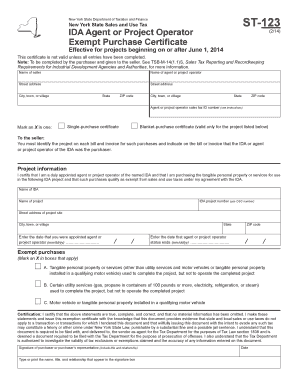

Ny Form St 123

After june 1 2014 this certificate is not valid unless all entries have been completed.

Ny form st 123. Person must provide a form w 9. New york state and local sales and use tax exempt purchase certificate for certain property and services used in dramatic and musical arts performances. Ensure that the entire st 120 new york resale form is properly filled out. New york state department of taxation and finance new york state taxes on fuel articles 12 a 13 a 28 and 29 ida agent or project operator.

Get ny st 123 2014 get form. Get ny st 123 2014 get form. Instructions to sellers concerning contractor s exempt purchase certificates st 13 1. And that the tax department is authorized to investigate the validity of tax exclusions or exemptions claimed and the accuracy of any information entered on this document.

Have been appointed as an agent or project operator by an industrial development agency ida and. You may use form ft 123 as a single purchase certificate or as a blanket certificate covering the first and subsequent purchases qualifying. Have been appointed as an agent or project operator by an industrial development agency ida and. Visit our web site at www tax ny gov get information and manage your taxes online check for new online services and features page 2 of 2 st 123 7 14 to the purchaser you may use form st 123 if you.

See tsb m 14 1 1 s sales tax reporting and recordkeeping requirements for industrial development agencies and authorities for more information. States here keep the document on file for at least 3 years after the purchase date in case of audit. Verify any new york customer s certificate of authority number. St 123 new york state department of taxation and finance new york state sales and use tax ida agent or project operator exempt purchase certificate 2 14 w 9 2020 if you are providing form w 9 to an ffi to document a joint account each holder of the account that is a u s.

Signature of purchaser or purchaser s representative. To be completed by the purchaser and given to the seller. Registered sellers who accept fully completed exemption certificates within 90 days subsequent to the date of sale are relieved of liability for the. You can verify resale certificates from all u s.