Ny Nonresident Tax Form 2019

Page 2 of 19 it 205 i 2019 general instructions who must file the fiduciary of a new york state resident estate or trust must file a return on form it 205 if the estate or trust.

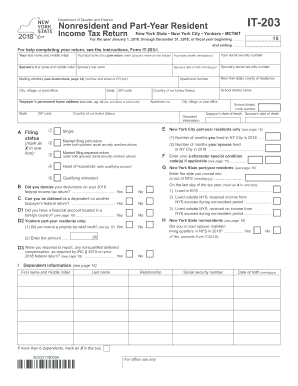

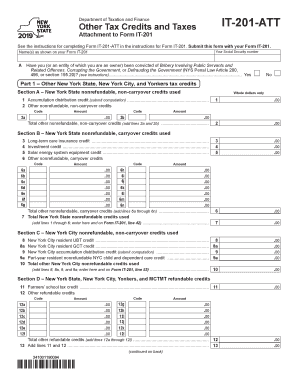

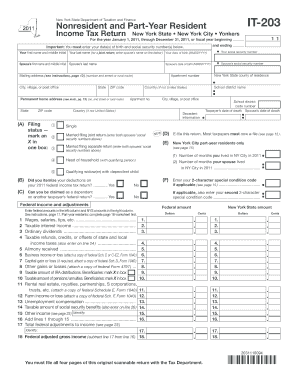

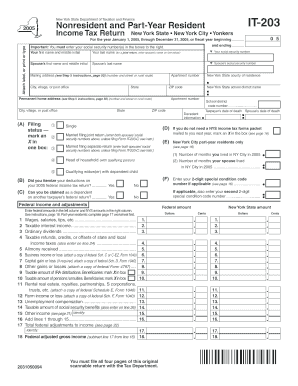

Ny nonresident tax form 2019. New york ny 10008 3933 forms claiming refunds. Form ct 1040nr py schedule ct si schedule ct 1040aw schedule ct pe schedule ct chet tax tables tax calculation schedule use. Form it 203 requires you to list multiple forms of income such as wages interest or alimony. 56 00 57 part year yonkers resident income tax surcharge form it 360 1 57 00 58 total new york city and yonkers taxes surcharges and mctmt add lines 54 and 54b through 57 58 00 59 sales or use tax as reported on your original return see instructions.

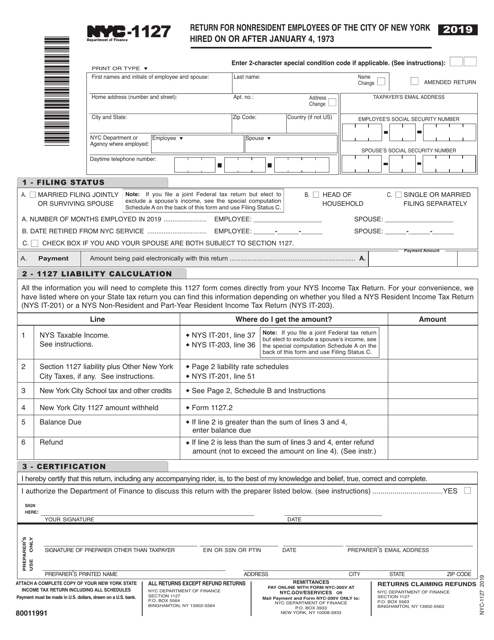

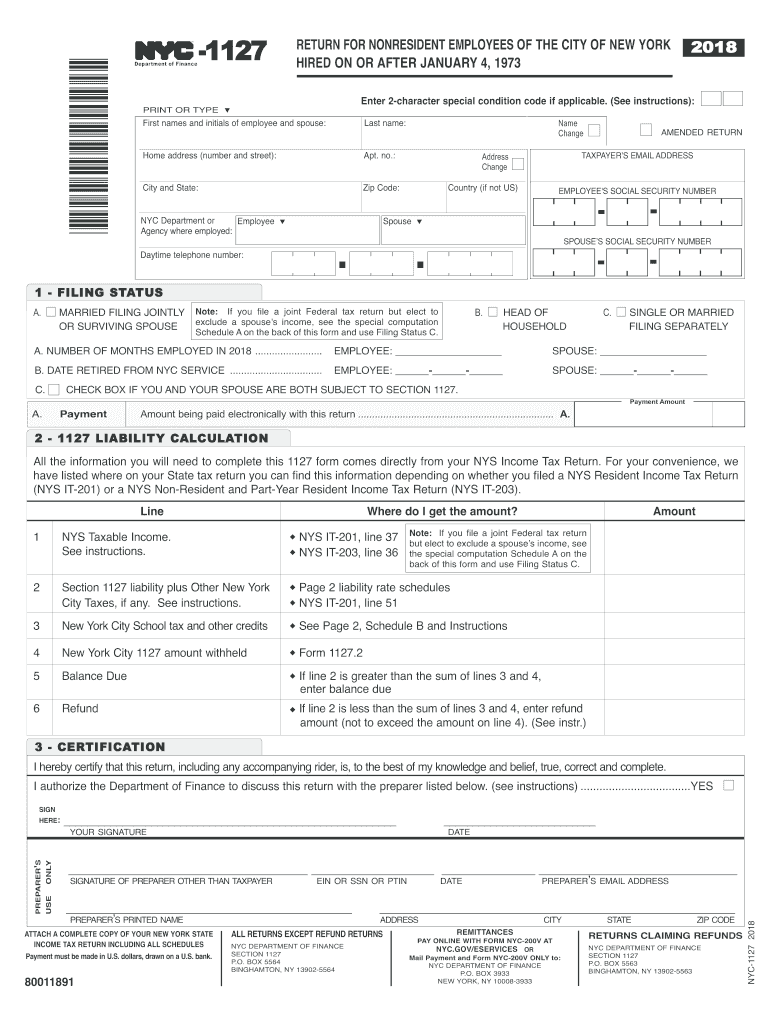

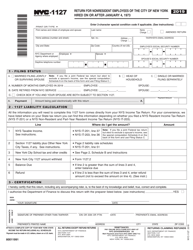

From outside new york city call 212 639 9675. 2019 it 203 i general information 7 access our website at www tax ny gov how are nonresidents and part year residents taxed. If you were a nonresident of new york state you are subject to new york state tax on income derived from new york state sources. Box 5563 binghamton ny 13902 5563 if you have been granted an extension of time to file either your federal income tax return or your new york state tax return form nyc 1127 must be filed within 15 days after such extended due date.

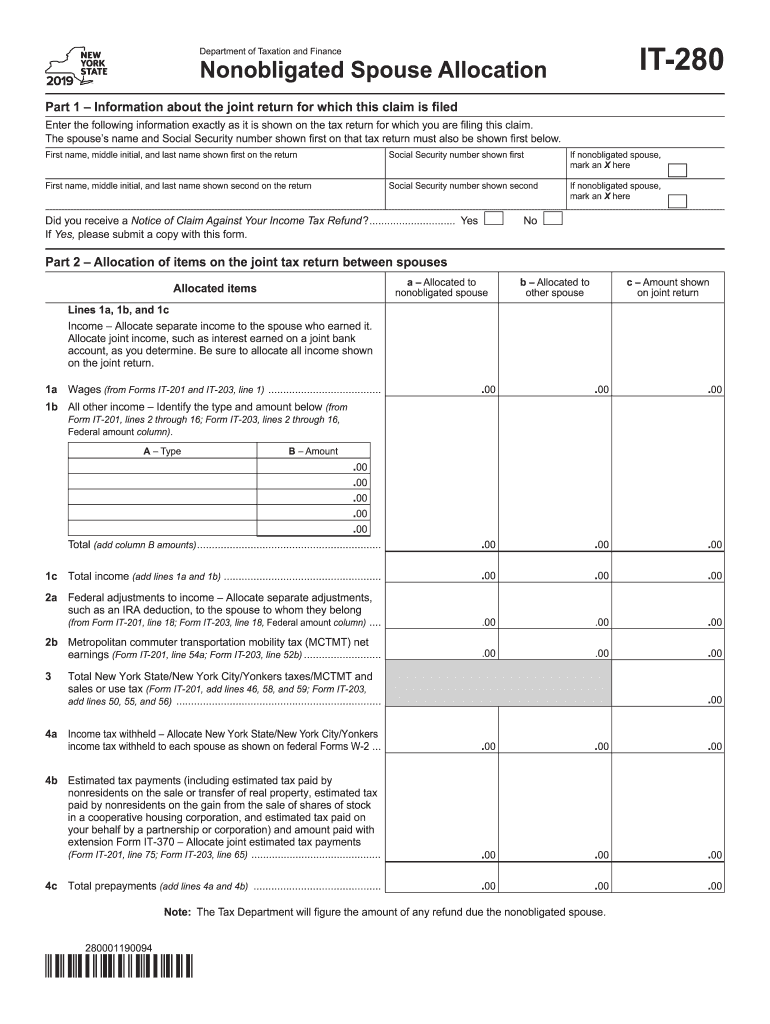

For tax year january 1 2019 december 31 2019 or other tax year beginning 2019 ending 2020 nj residency status if you were a new jersey resident for any part of the tax year give the period of new jersey residency. Is required to file a federal income tax return for the tax year. More about the new york form it 203 individual income tax nonresident ty 2019 form it 203 is the nonresident and part year resident income tax return. 203001190094 department of taxation and finance nonresident and part year resident income tax return new york state new york city yonkers mctmt it 203 eyork city part year residents onlynew see page 15 1 number of months you lived in ny city in 2019.

Nonresident real property estimated income tax payment form valid for sales or transfers date of conveyance after december 31 2019 but before january 1 2021 it 2664 fill in 2020 it 2664 i instructions. We last updated new york form it 203 in january 2020 from the new york department of taxation and finance. Nyc department of finance section 1127 p o. This form is for income earned in tax year 2019 with tax returns due in april 2020 we will update this page with a new version of the form for 2021 as soon as it is made available by the new york government.

Nonresident and part year resident income tax return instructions 2019 form ct 1040 nr py this booklet contains information or instructions for the following forms and schedules. 2 number of months your spouse lived in ny city in 2019.