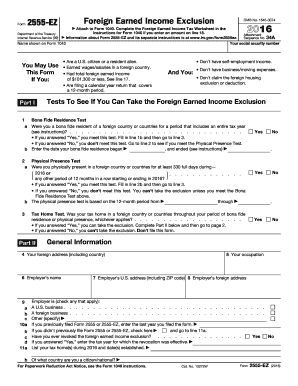

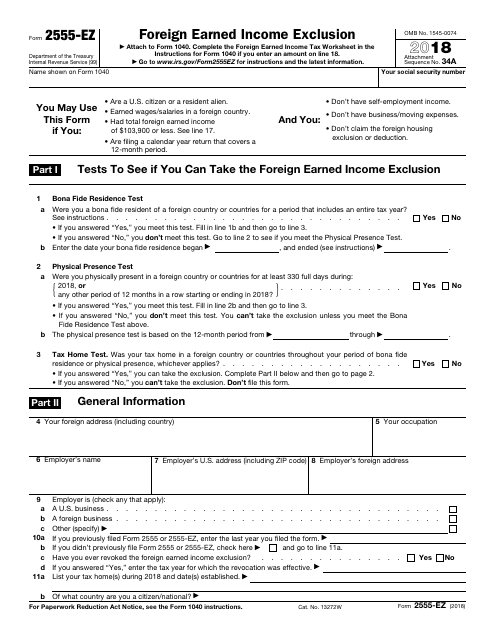

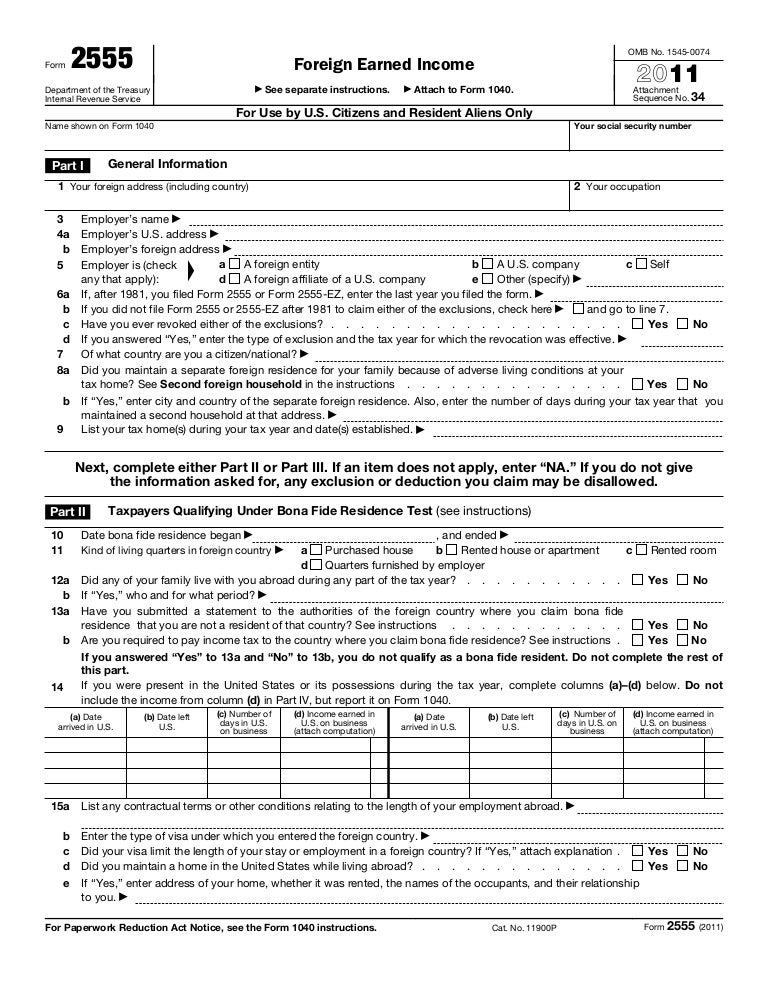

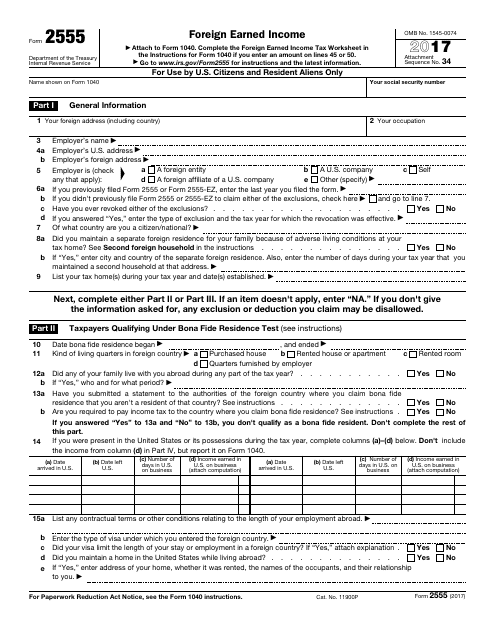

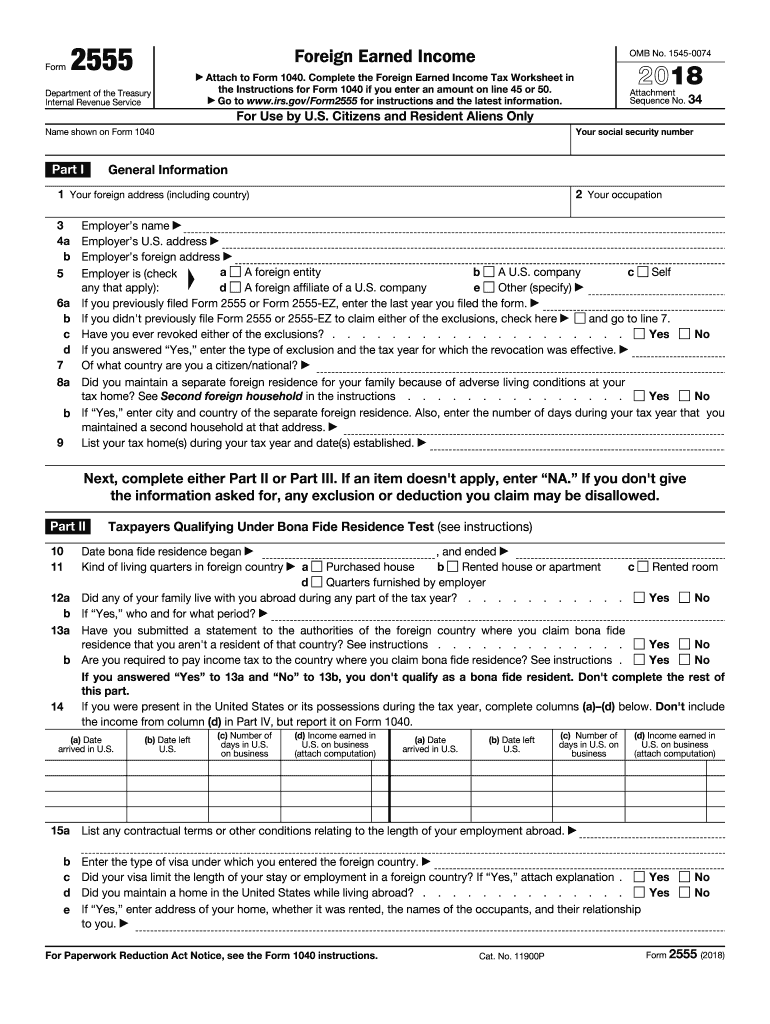

Tax Form 2555 Ez Foreign Earned Income

Form 2555 ez is a simplified version of form 2555 that was designed to make it easier for taxpayers to file.

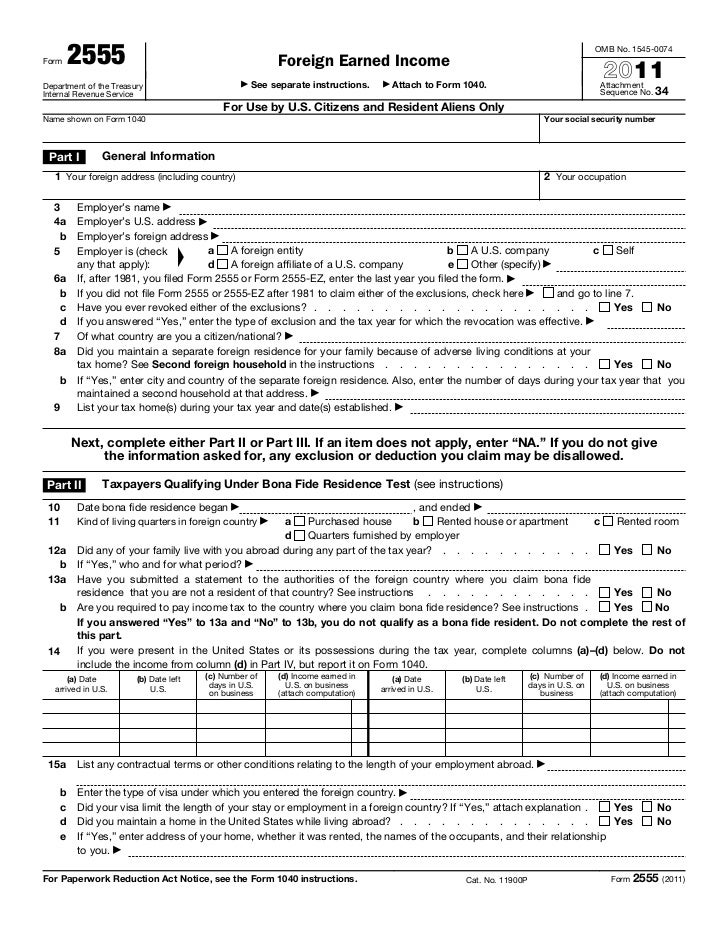

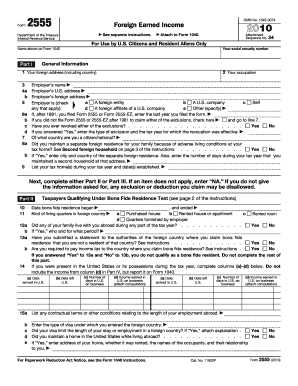

Tax form 2555 ez foreign earned income. Fill out forms electronically utilizing pdf or word format. Form 2555 shows how you qualify for the bona fide residence test or physical presence test how much of your foreign earned income is excluded and how to figure. Approve forms using a lawful electronic signature and share them through email fax or print them out. You must attach form 2555 foreign earned income to your form 1040 or 1040x to claim the foreign earned income exclusion the foreign housing exclusion or the foreign housing deduction.

Figuring the tax if you qualify for and claim the foreign earned income exclusion the foreign housing exclusion or both must figure the tax on your remaining non excluded income using the tax rates that would have applied had you not claimed the exclusion s. Make them reusable by making templates include and complete fillable fields. Citizens and resident aliens abroad form 2555 and form 2555 ez. Improve your productivity with effective service.

Form 673 statement for claiming exemption from withholding on foreign earned income eligible for the exclusion s. Download files on your computer or mobile device. Instructions for form 2555 ez foreign earned income exclusion. Starting with the 2019 tax year form 2555 ez can no longer be used to claim the foreign earned income exclusion.

Publication 54 tax guide for u s. Do not submit form 2555 by itself. Use the foreign earned income tax worksheet in the form 1040 instructions.