Bir 2316 Form 2020

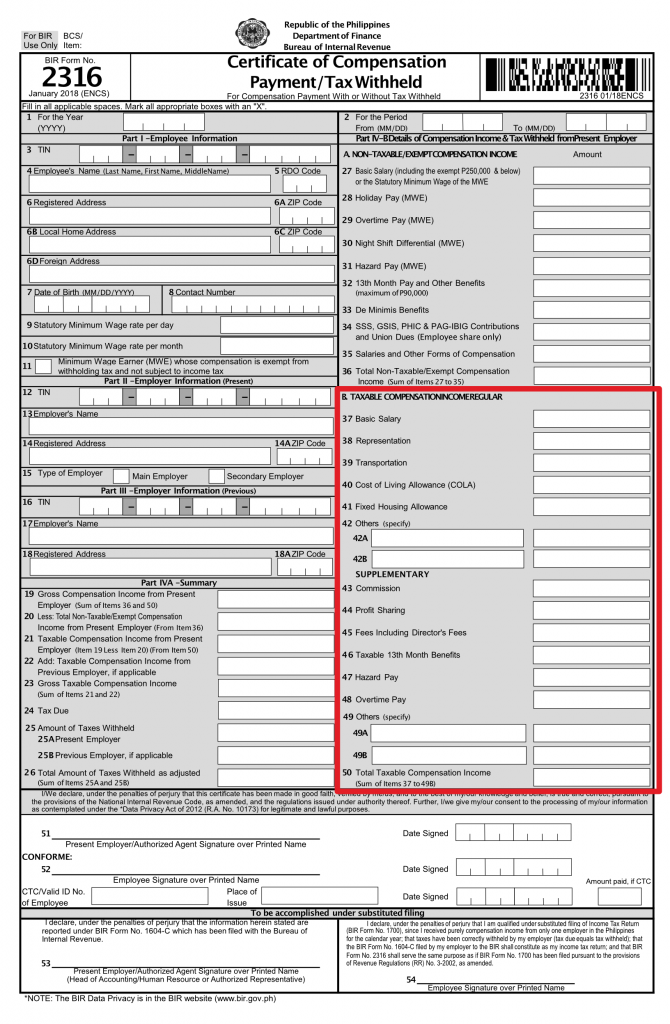

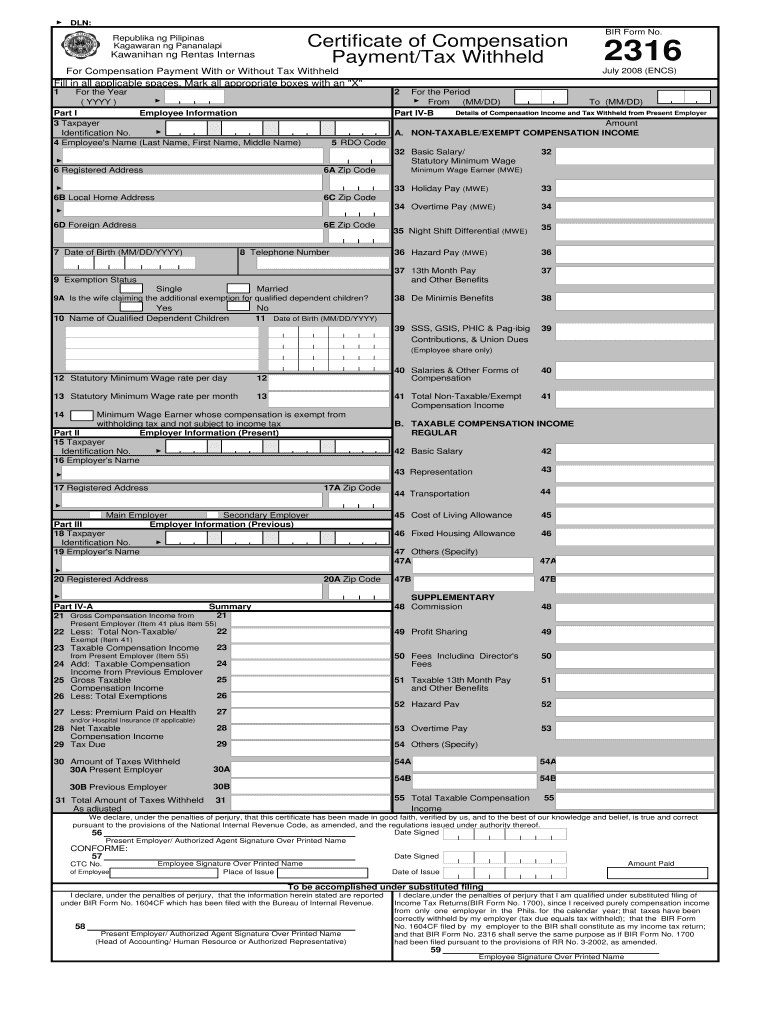

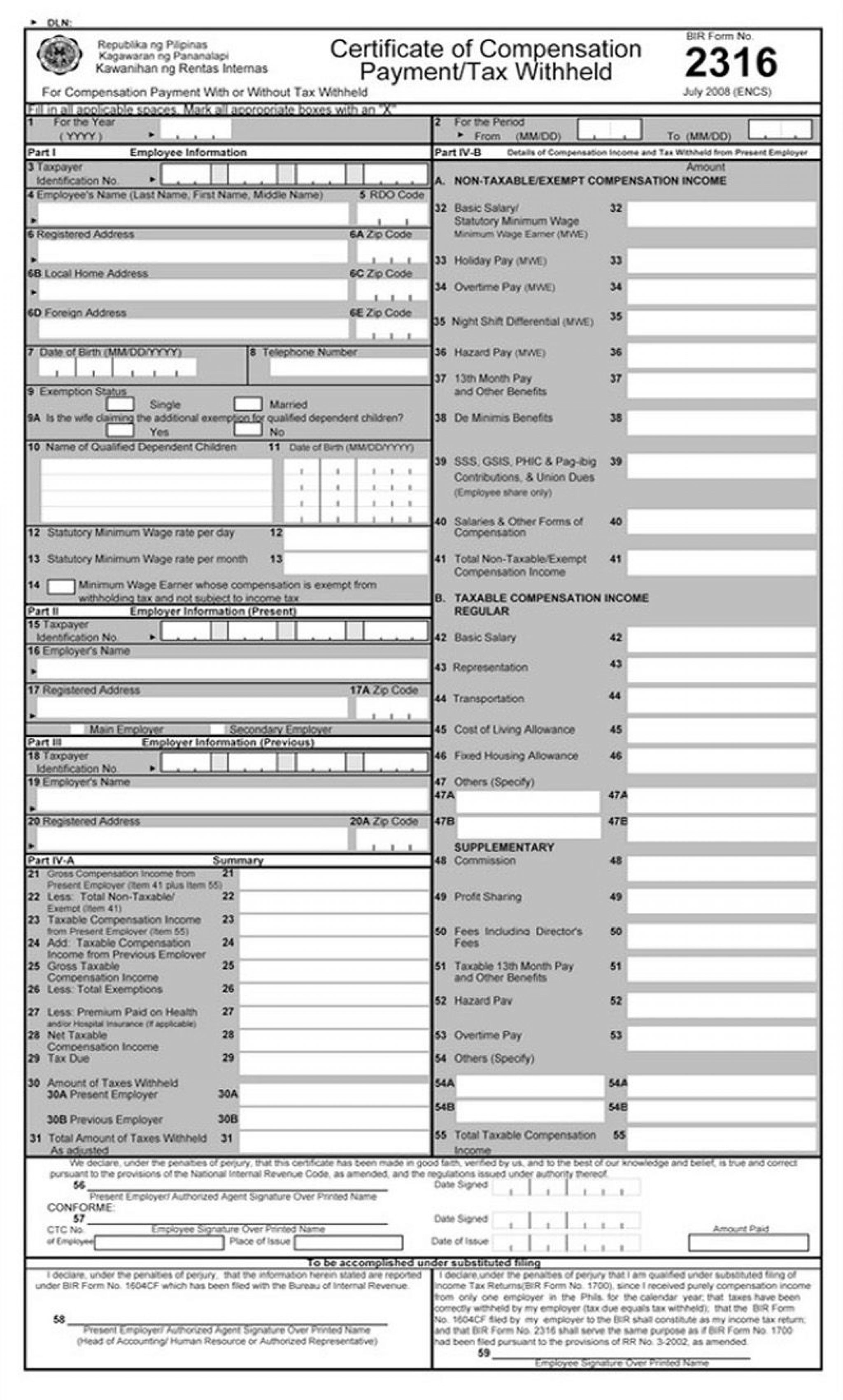

The bureau of internal revenue bir recently issued revenue memorandum circular 100 2019 prescribing the use of revised bir form 2316 certificate of compensation payment tax withheld january 2018 which was amended due to the implementation of republic act 10963 also known as the tax reform for acceleration and inclusion law.

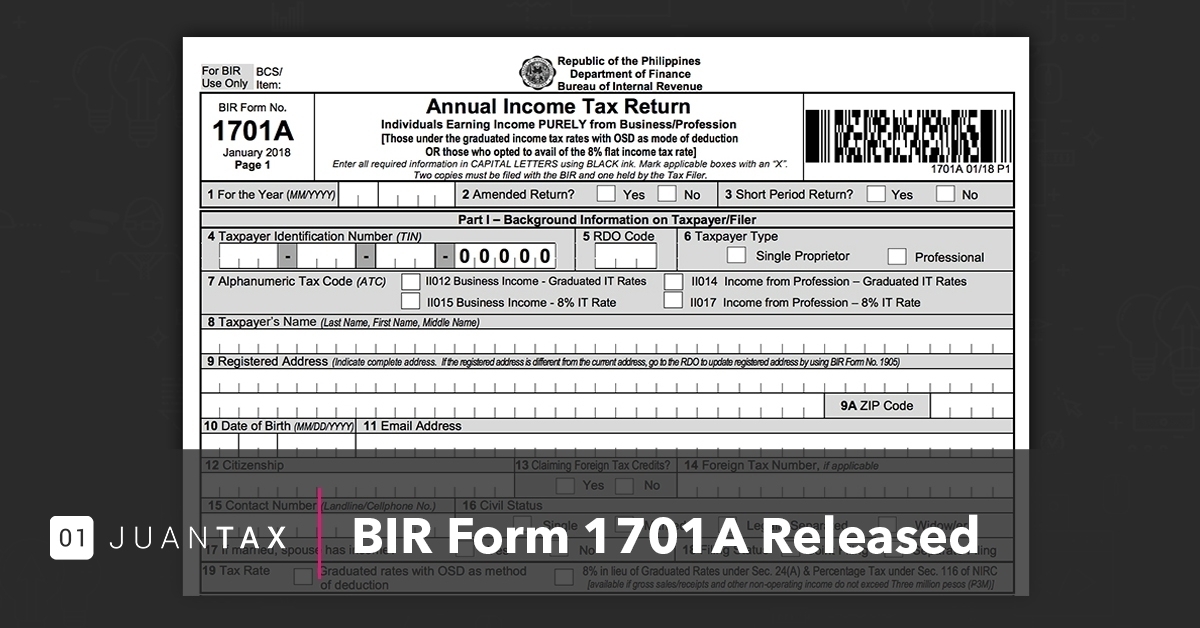

Bir 2316 form 2020. This article was updated on 2 march 2020 to take into account the deadline extension for the filing of bir form 2316. Circularizes the availability of offline electronic bureau of internal revenue forms ebirforms. 30 and those exempted in sec. Employers in the philippines must submit bir form 2316 in relation to each employee every calendar year.

The bir form 2316 tax filing follows the bir s definition of compensation these are salaries wages and other forms or remuneration by each employer it shows the total annual salary of the employee and the taxes filed within the year thus the terms certificate of compensation payment and income tax withheld. 1700 had been filed pursuant to the provisions of rr no. 1604cf filed by my employer to the bir shall constitute as my income tax return and that bir form no. As a proof of this withholding employers are required to prepare and release bir form 2316.

Further under the conforme section a valid id is now an option in place of declaring the community tax certificate information. Annual income tax return for corporation partnership and other non individual taxpayers exempt under the tax code as amended sec. Open form follow the instructions. Bir requires the employer to withhold taxes from employee s compensation based on the new train law that took effect at the start of 2018.

Rate bir form 2316 as 5 stars rate bir form 2316 as 4 stars rate bir form 2316 as 3 stars rate bir form 2316 as 2 stars rate bir form 2316 as 1 stars. Send filled signed form or save. 1604 cf and extends the deadline for submission of certificate of compensation payment bir form no. Hi gabotaf pa kaway kaway po sa may alam ng updated bir alphalist version for the preparation of revised form 2316.

Annual income tax return for corporation partnership and other non individual taxpayer subject only to regular income tax rate. Easily sign the form with your finger. Prescribes the use of old bir form nos. 27 c and other special laws with no other taxable income.

Updated alphalist data entry bir form 2316 17 jan 2020 gabotaf government taxation 1 q. 2316 shall serve the same purpose as if bir form no. Get and sign bir form 2316 2008 2020 how it works. Taxes bir form no.