Form 26as Form 16

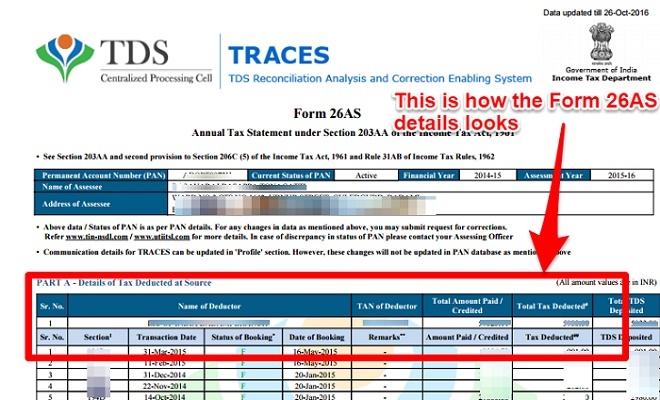

The tds amounts reflected in form 26as and form 16 16a should always be the same.

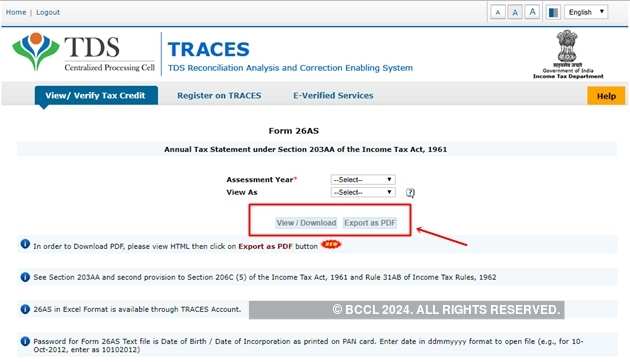

Form 26as form 16. Perform the following steps to view or download the form 26as from e filing portal. Go to the my account menu click view form 26as tax credit link. Form 26as tax credit as we have seen above form 16 and form 16a are used by the employer for tds deduction. Most banks and financial institutions use form 16 as part of their verification process when you apply for a loan of any kind like housing loan.

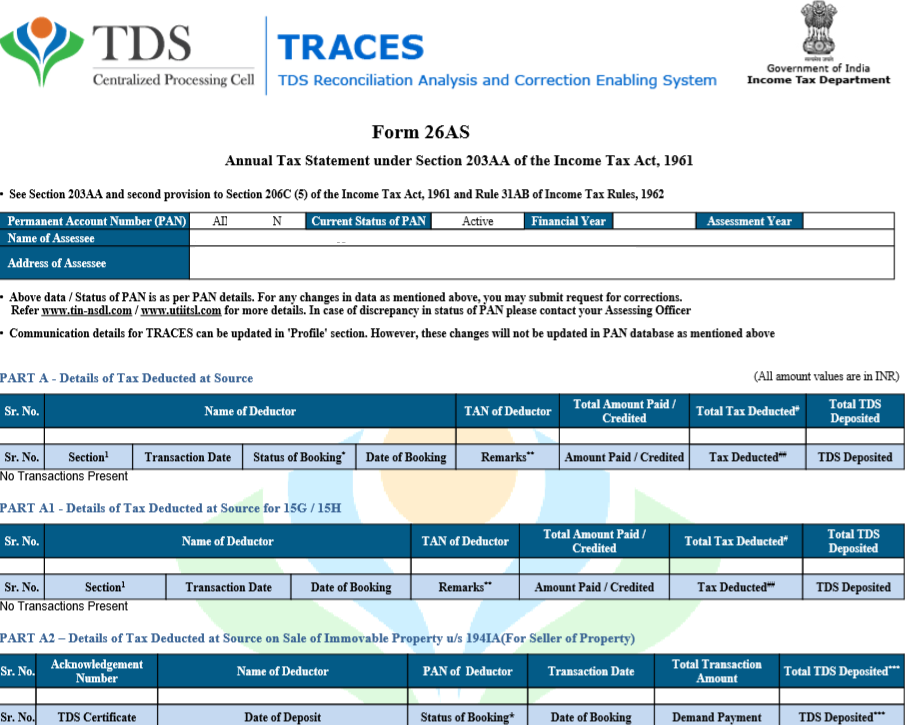

This is where form 26as comes into the picture. Ideally the tds amounts reflected in form 26as and form 16 16a should always match. Form 26as is a consolidated tax credit statement. I am filling my return online.

How to match form 16 and form 26as. If there are discrepancies the income tax department considers the tds figures as per the form 26as only. So tax deductions that are shown in form 16 form 16 a can be cross checked and verified using form 26as. So tds deductions that are given in form 16 form 16 a can be cross checked using form 26as.

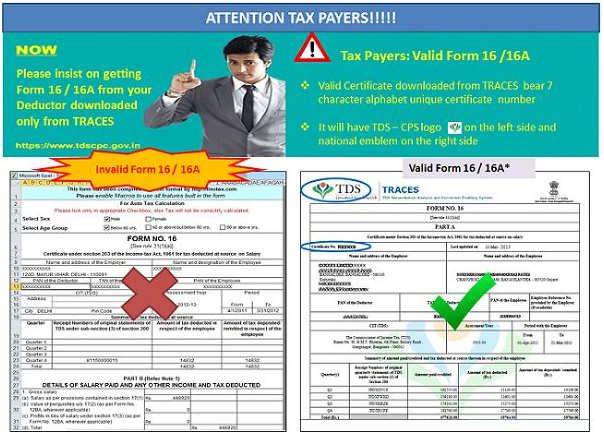

Kindly advise on further action. Logon to e filing portal www incometaxindiaefiling gov in. Form 26as also provides the details of tax refunds if any received by you from the income tax department in the financial year. During income tax return filing season you come across two income tax forms very frequently that is income tax form 16 and form 26as.

Tax return and form 16. Read the disclaimer click confirm and the user will be redirected to tds cpc portal. Income tax form 16 specifies details of your salary income and tax deducted and deposited by your employer whereas form 26as gives overall view of tax deducted for your pan at various sources. The form 26as contains details of tax deducted on behalf of the taxpayer you by deductors employer bank etc.

If there are discrepancies the it dept will consider. My form 16 and 26as are in agreement. Both form 16 and form 26as will come in handy when filing your income tax returns. The tds details in form 16 and the actual amount deposited with the government in form 26as should match.

The auto updated as per e filing details of tds in sch tds 1 are different than that shown in the form 16 26as. Form 26as contains details of tax deducted on behalf of the taxpayer by deductors employer bank etc. Salary in form 16 is annual salary 26as shows salary on which tds paid tax deducted from salary has been filled in tds 1 but my gross salary is more than that shown in 26as. Form 26as is an annual consolidated tax statement recording all transactions where various taxes on your income have been deducted at source like tax deducted on salary tax deducted on fixed deposit income if any or tax deducted on commission income etc.

So tds deductions that are given in form 16 form 16 a can be cross checked using form 26as.