Revised Form 24q Annexure Ii

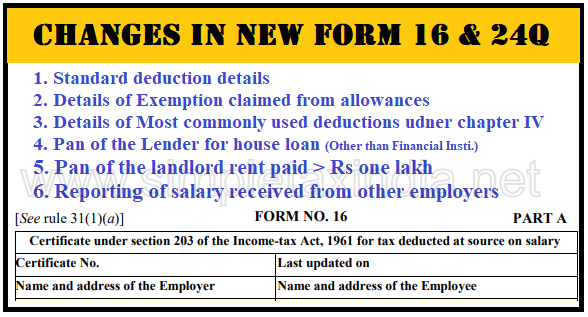

Cbdt notifies revised form 16 part b form 24q salary details in q4.

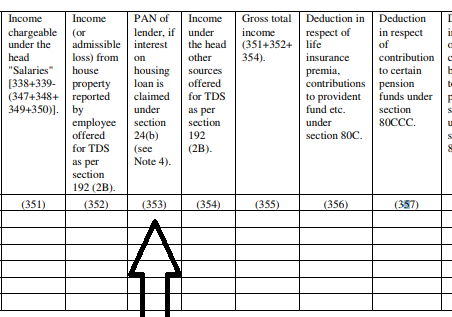

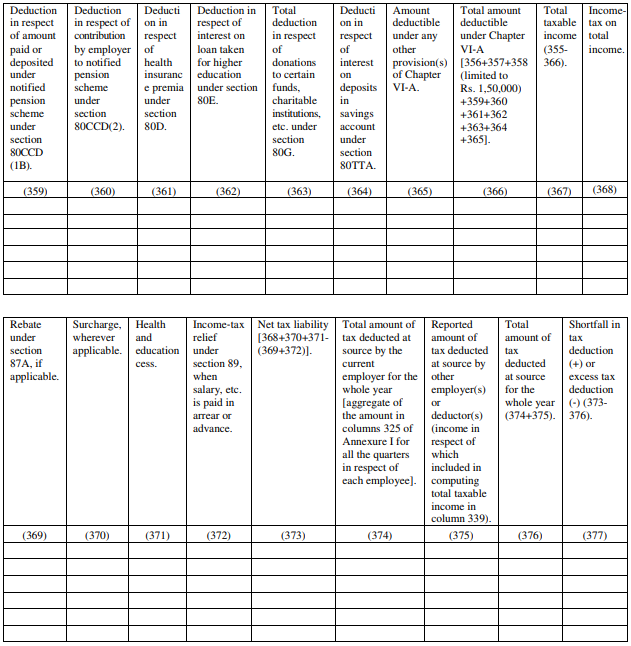

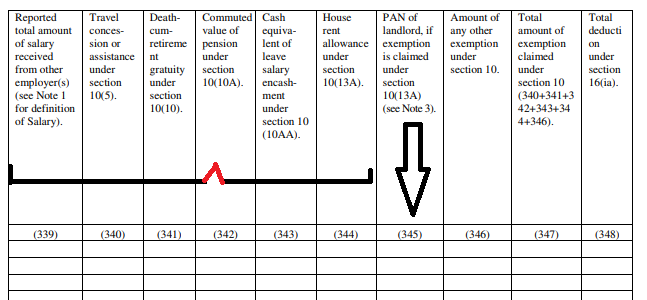

Revised form 24q annexure ii. Government deductors to fill information in item i of part a if tax is paid without production of an income tax challan and in item ii of part a if tax is paid accompanied by an income tax challan. The revised form 24q annexure ii has brought certain changes with regard to the reporting of transactions while filing the tds statements. It is therefore advised that due diligence may be exercised to ensure accurate tds statement filing so as to avoid possible defaults mismatch in tds certificate form 16 part b which shall be available for download from traces. 24q annexure ii has been revised.

Tds certificate form 16 part a part b download procedure. The revised form 24q annexure ii has brought certain changes with regard to the reporting of transactions while filing the tds statements. The revised form 24q annexure ii has brought certain changes with regard to the reporting of transactions while filing the tds statements. 24q for annexure ii.

The form 16 and 24q have been amended to make them more elaborative and informative. It is therefore advised that due diligence may be exercised to ensure accurate tds statement filing so as to avoid possible defaults mismatch in tds certificate form 16 part b which shall be available for download from traces. It is therefore advised that due diligence may be exercised to ensure accurate tds statement filing so as to avoid possible defaults mismatch in tds certificate form 16 part b which shall be available for download from traces. Latest updates on functionalities utilities liked to 24q form 16 part b pdf conversion utility will be made available before 6 th june 2109.

Only deductor details challan details and deductee details annexure i have to be furnished for the first three quarters. The notification shall come into force w e f. Online correction for form type 24q q4 add delete salary details annexure ii has been disabled for f y. Form 16 and 24q have been amended to make them more elaborative and informative.

While furnishing form 24q for the first three quarters annexure ii salary details need not be furnished. Download ds annexure 24q. To download revised form 16 format in excel click here. However for the fourth quarter annexure ii which gives salary details of the deductees has to be furnished.

The notification shall come into force w e f. Ministry of finance department of revenue central board of direct taxes notification new delhi the 12th april 2019. Click here to download revised form 16. The same has been done important information regarding revised form no.

Annexure i and annexure ii to form 24q in excel format by karvitt which you can fill before print on your pc laptop. 24q annexure ii has been revised. Applicability of the notification as per cbdts notification 36 2019 dated 12th april 2019 the format of tds statement in form no.